Private markets have grown significantly in importance over the past two decades, and this trend is set to continue in the coming years as more and more professional investors discover the attractions of the asset class. In this article, we explain the appeal of private markets and why you should consider an allocation to the sector through one of Petiole’s investment solutions.

Once considered a niche sector, alternative assets – an area of unlisted assets that includes private equity, private debt, private real estate, hedge funds, infrastructure, and natural resources – is set to surpass US$17 trillion in assets under management (AUM) within the next four years, according to the London-based investment data company Preqin. Private equity and private debt, says Preqin, will drive this growth. (1)

The resilience of private markets during the COVID-19 pandemic has underlined the growing maturity of the asset class. Private-market AUM increased to a record high of US$7.4 trillion by the end of 2020, an increase of 5.1% over the year, despite the devastating impact of the coronavirus on global economies and heightened risk aversion among investors for much of this period. (2) By contrast, private-market investors retrenched and missed out on much of the recovery in valuations that took place following the global financial crisis of 2008.

Source: Preqin

Source: Preqin

Key Drivers of Growth

I. Higher Returns

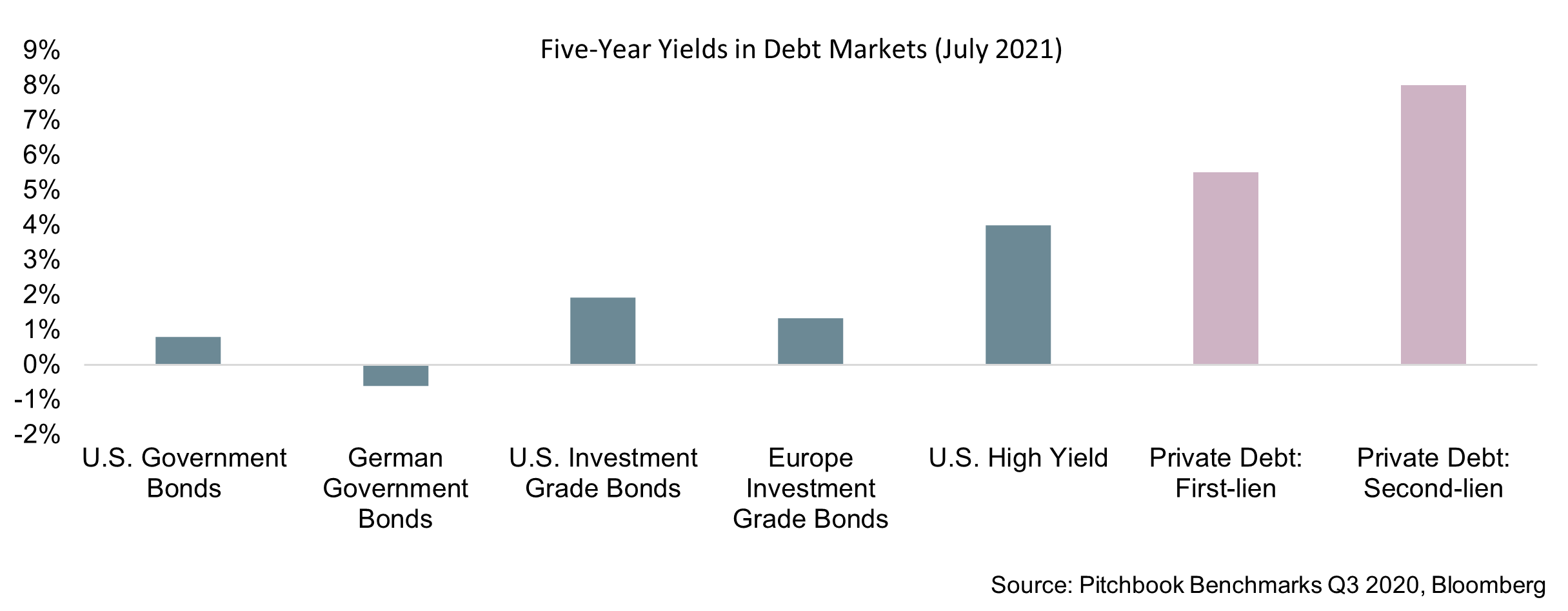

The main factors driving investor flows into private markets include historically low yields in fixed income and high stock-market valuations.

Historical records clearly illustrate the decline in bond yields. That has prompted investors to explore the illiquidity premium offered by private markets: estimated at around 2.5% for private debt and over 4% for private equity, sufficient to generate compelling returns when compared with listed assets.

The higher rewards generated by private markets have been consistently demonstrated over much of the past two decades. Since 2001, the returns achieved by investing in a diversified private-markets portfolio have been double those of a public markets portfolio.

II. Lower Volatility

II. Lower Volatility

At the same time, private equity and debt compare well to investments in emerging-market debt, high-yield bonds, and public equity markets in terms of volatility. When stock markets crashed and lower-rated debt yields soared in March 2020, following the COVID-19 outbreak, valuations in private markets remained steady, reflecting the relative illiquidity of these investments.

III. Diversification and Growth Potential

Private markets provide exposure to riskier start-ups with rapid growth potential, as well as mature private companies delivering steady growth, not available through public markets. Companies were staying private for longer even prior to the pandemic, and this trend is likely to develop further in the current uncertain economic environment. Moreover, the pandemic has opened up new opportunities for private market investors in areas such as real estate and infrastructure (given the growing pressures on public finances) and in technology (to drive the growth of companies seeking to capture the opportunities in e-commerce and elsewhere).

Key Sectors

At Petiole Asset Management, we focus on three main areas in private markets: equity, debt and real estate.

I. Private Equity Booms

Global private equity activity more than doubled in 2021 to US$2.1 trillion from the previous year. Moreover, private equity buyouts accounted for a record 27% of all global M&A activity. (3) The rebound underlines one of private equity’s strengths, namely, its ability to thrive in times of economic dislocation and to pick up distressed assets at attractive prices.

Private equity has certainly demonstrated an ability to generate consistently superior returns over economic cycles.

Since 2001, private equity’s returns have outperformed those of public equity by 4% annually. Over the last 20 years, an amount invested in private equity would have grown by three times as much as the same figure invested in public equity.

In addition, while many investors view private equity as being riskier than listed assets, the opposite is true, as is illustrated below.

II. Private Debt’s Appeal to Income-Hungry Investors

II. Private Debt’s Appeal to Income-Hungry Investors

In an era of low yields, private debt generates an attractive, alternative source of income. Unsurprisingly, the sector is expanding rapidly – the AUM of funds primarily involved in direct lending has surged tenfold over the past decade, to US$412 billion at the end of 2020, according to S&P Global. (4)

The growth of the sector has turned into a virtuous circle, adds S&P. It explains that institutional investors have been attracted by the prospect of higher yields relative to other fixed-income assets, higher allocations, quicker execution, and expectations for consistent risk-adjusted returns. This increased demand, in turn, has attracted borrowers and private-equity sponsors looking for an alternative to syndicated loans to fund small- to mid-market deals. Moreover, while private debt has consistently delivered returns close to those of corporate debt, the Sharpe ratio of private debt has outperformed that of investment-grade and corporate bonds consistently over time.

Moreover, while private debt has consistently delivered returns close to those of corporate debt, the Sharpe ratio of private debt has outperformed that of investment-grade and corporate bonds consistently over time.

While private markets are generally considered to be long-term investments, private debt suits investors with a shorter-term horizon; the average holding period for private debt instruments is three to five years.

III. Private Real Estate: Proven Track Record

III. Private Real Estate: Proven Track Record

Private real estate offers better protection against inflation, higher income, and lower volatility than public real-estate markets. Private real estate consistently generated superior returns to public real estate from 2010 to 2018. Over the past 10 years, private real estate has declined on just three occasions, with an average fall of 0.98%. By contrast, listed real estate has fallen 11 times, with an average drop of 6.75%. Furthermore, private real estate offers significant diversification to a portfolio, offering negative or low correlation to stock and bond markets – in sharp contrast to its listed counterpart. Private real estate generated superior returns through the pandemic, with an average annual income of 7.5% in the year to July 2020, compared with just 5% from the REITS index.

Private real estate generated superior returns through the pandemic, with an average annual income of 7.5% in the year to July 2020, compared with just 5% from the REITS index.

Why Choose Petiole for Private Markets?

Why Choose Petiole for Private Markets?

Petiole has navigated several economic cycles over nearly two decades of investing, and has successfully managed a dynamic allocation in private markets. Petiole’s private market investment solutions are aimed at large-scale institutional clients, independent managers, and qualified investors. Following an analysis of their requirements, and after identifying the best strategy to meet their goals, Petiole provides access to three different solutions:

Capital Yield: a portfolio of private investments generating a steady income

Capital Growth: a portfolio of private assets designed to deliver long-term capital appreciation

Thematic: exploits dislocations and unique themes that the team has identified, such as opportunities among discounted and undervalued US banks

Petiole emphasizes diversification across multiple asset classes, sponsors, strategies, and geographies. To find out how Petiole can help you access private markets, please get in touch with our team.

Key Takeaways

Private markets offer better returns, allied to lower volatility, than their listed counterparts.

Private markets bring diversification to a portfolio, offering access to a wide range of investments not available in public markets.

Petiole understands the challenges investors face in private markets and can provide customized solutions based on expertise and sponsor network established over nearly two decades.

References:

Investors rush into private markets in search of returns, Financial Times, 29 November 2021

A Year of Disruption in Private Markets, McKinsey & Company, April 2021

Global private equity delivers groundbreaking 2021, White & Case 13 January 2022

Private Debt: A Lesser-Known Corner of Finance Finds The Spotlight, S&P Global

Interested in learning more?