The asset management industry could leverage its power to effectively influence companies on their ESG weaknesses and generate positive risk-adjusted returns and new opportunities for investors.

Petiole Joins PRI

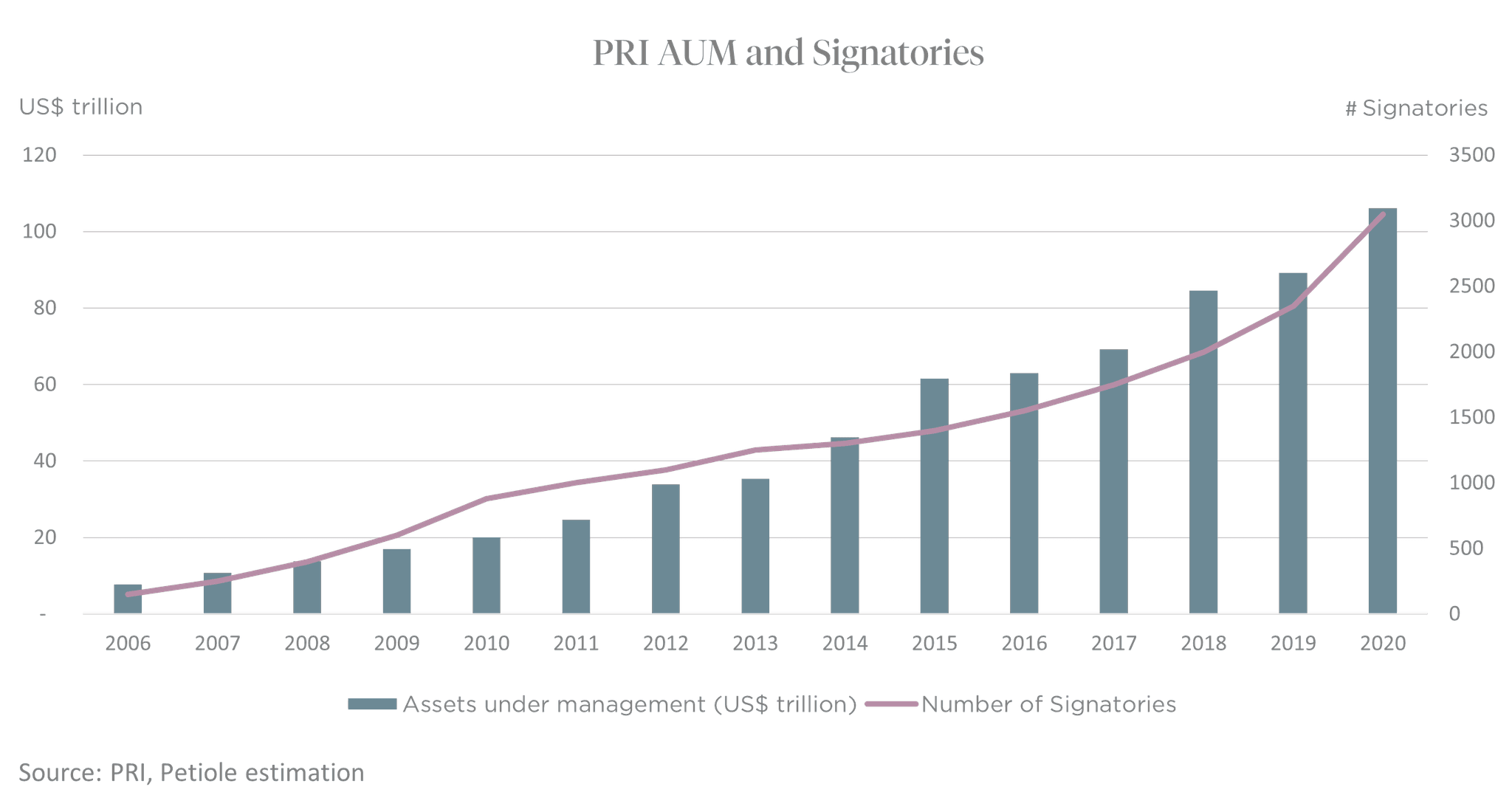

Petiole Asset Management is pleased to become a signatory of Principles for Responsible Investment (PRI) on April 15, 2021. We are especially proud of this key milestone that demonstrates our commitment to a positive impact on the environment and society when conducting business with our clients and partners.

Petiole embarked on its ESG investing journey in early 2020. The decision to join the PRI was made after a 12-month internal consultation process which covered two working papers, a team survey, and 29 weekly team e-engagements.

RI has been gaining momentum in the asset management industry in recent years set in motion by the following:

Materiality. There is a growing recognition in the financial industry and in academia that ESG factors influence investor returns. The ESG factors can help identify long-term winners and losers. There is also growing evidence that an ESG strategy does not need to compromise performance, and could even manage risks better and improve returns.

Public Awareness. ESG issues and their importance for future generations, as well as to the global economy, are receiving more attention and wider support.

Stronger Regulations. Since the 2008 financial crisis, policy interventions surged driven by a realization among national and international regulators that the financial sector can effectively influence towards a better future for society. Some of these regulations tackle issues such as reducing carbon emissions, better access to affordable products and services, and promoting business ethics.

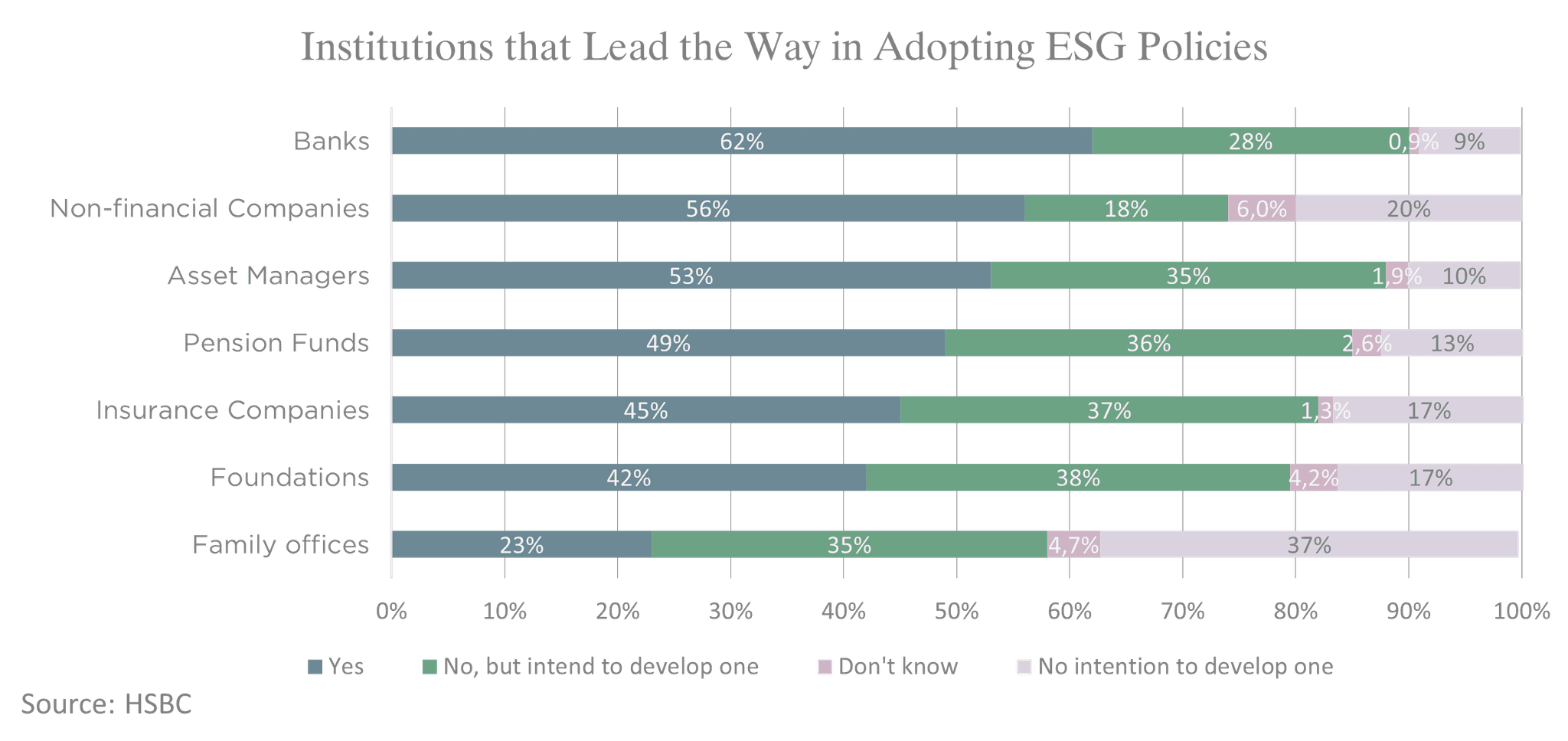

RI is Becoming Mainstream

The asset management industry generally believes that ESG investing is not just a trend, but the next evolution in investing. Recent surveys reveal that asset managers and investors are deploying more funds towards ESG principles:

• According to PricewaterhouseCoopers Private Equity Responsible Investment Survey 2019, 91% of respondents have already adopted or are currently developing a responsible investment policy, and 72% of respondents use or are developing KPIs to track, measure, and report on the progress of their policy.

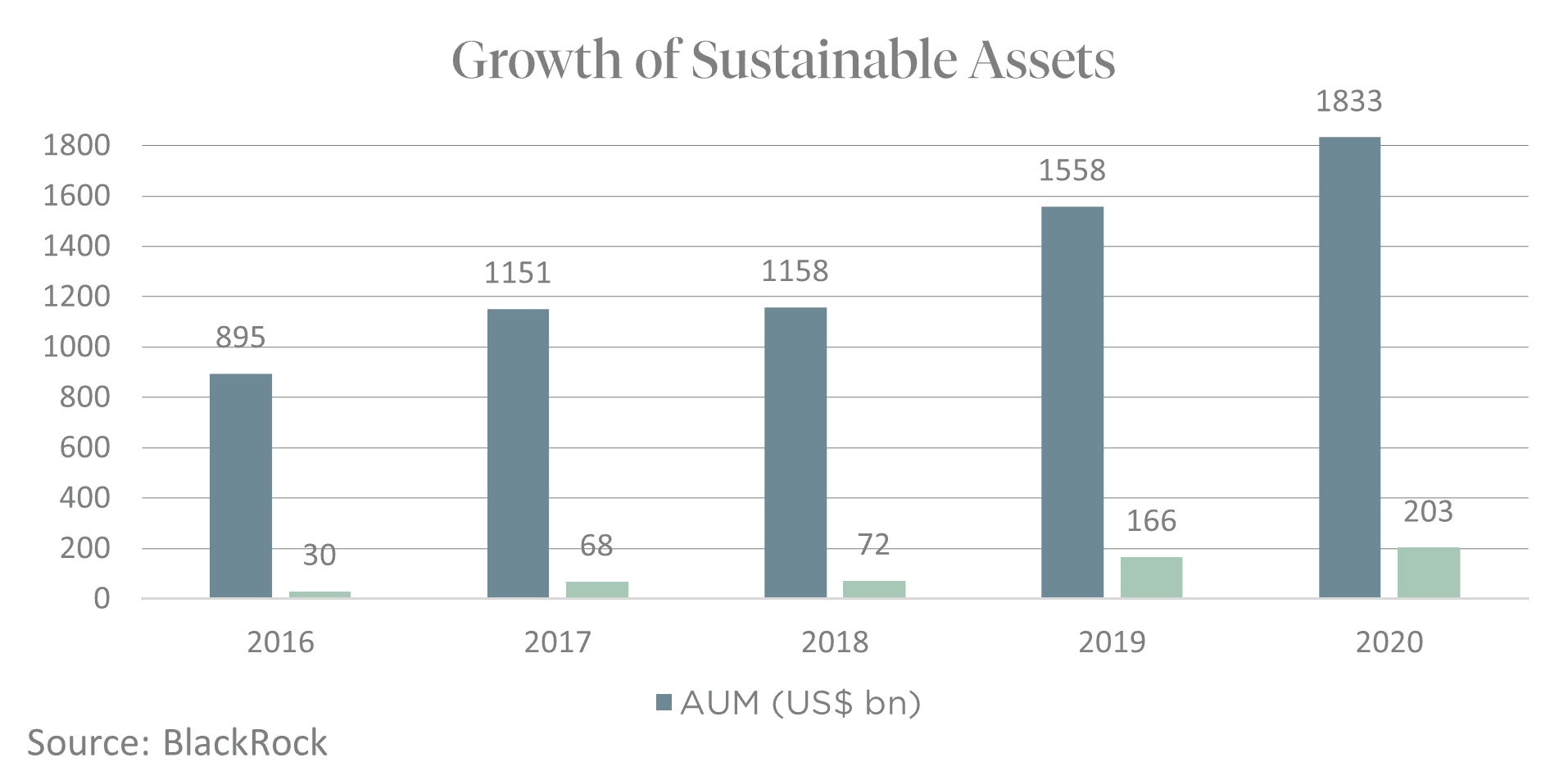

• In September 2020, UBS Wealth Management announced that it would recommend Sustainable Investing (an ESG strategy) over traditional investing to clients around the world. UBS is managing US$ 488 billion core sustainable assets out of its US$ 2.6 trillion global wealth management business.

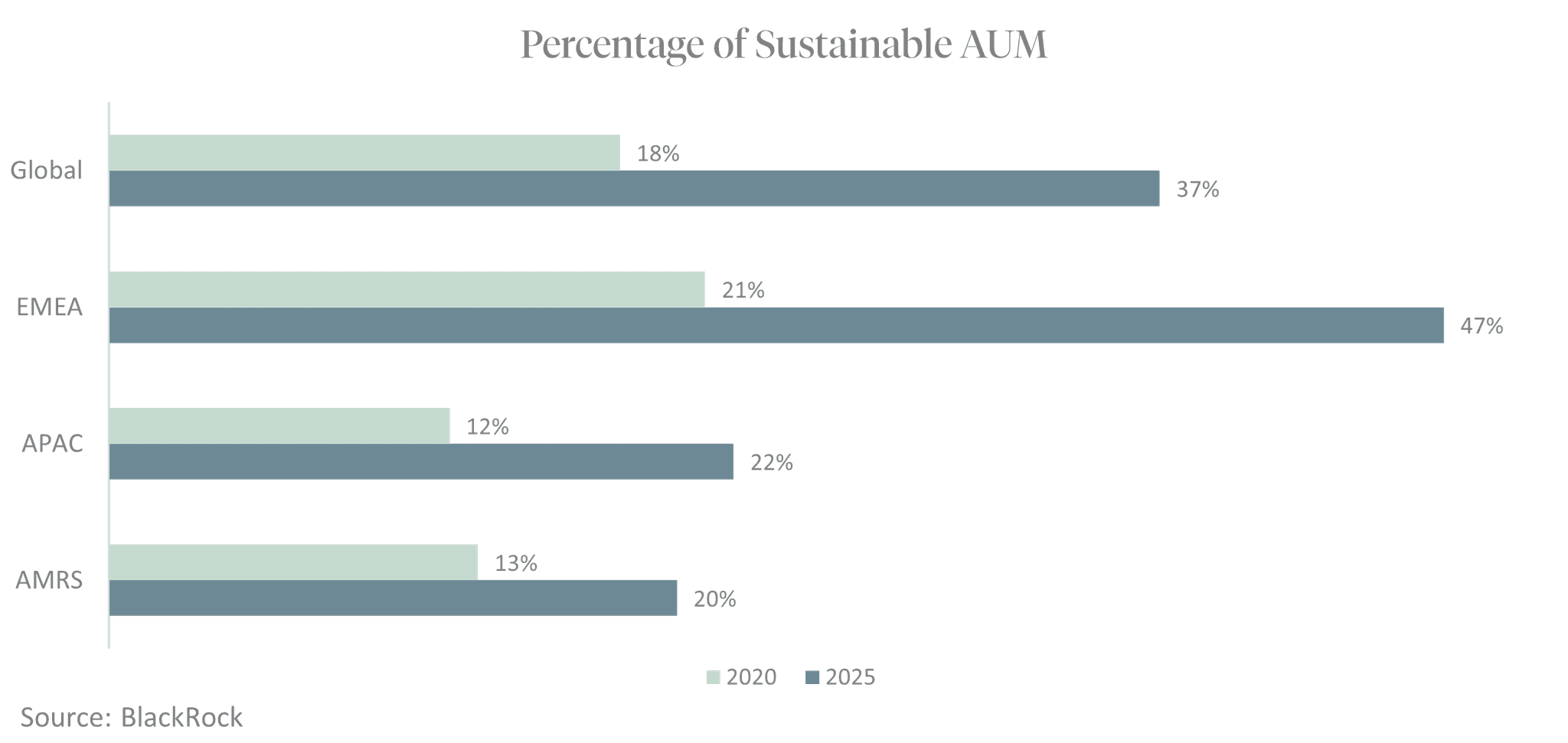

• The BlackRock 2020 Survey also shows that respondents, who represent an estimated US$ 25 trillion in assets under management (AUM), plan to double their sustainable AUM in the next five years – rising from 18% to 37% in 2025.

RI is a broad term encompassing a range of investment approaches that consider the ESG factors, such as screening, thematic investing, and impact investing. At one end of the spectrum, a manager could practice RI simply by screening the investments in the portfolio. At the other end, the manager could dedicate to investing in assets that generate social or environmental goods.

Exclusionary Screening: Avoiding to invest in companies or sectors that do not align with investor values or meet other norms or stands

Positive Screening: Actively seeking out companies deemed well-performing on certain ESG criteria

Thematic: Focusing on investments according to interest in specific ESG themes, such as clean energy, water, education, or healthcare

Impact: Investing in companies or funds with the intention to generate a measurable, beneficial social or environmental impact alongside a financial return

Petiole uses exclusionary screening and positive screening as its core RI approaches when making investment decisions while maintaining financial returns as the primary purpose.

RI Means More Than Just ‘Feel Good’

RI is more than just a ‘feel good’ story - the asset management industry has the choice to make a commitment to conduct business that will not only lead to positive risk-adjusted returns and new opportunities for investors, but could also help address some of the world’s pressing challenges to make a better society and a more livable planet in the future.