The Covid-19 recovery has been more robust than previous post-recession recoveries, but will that continue? The following chart shows that the average recovery phase in past recessions has lasted approximately 15 months. With global economic activity rebounding, and monetary and fiscal support likely to be withdrawn, we may be past the recovery phase and we must be prepared for a new moderation regime where growth stabilizes and volatility increases. The Great Revival

The Great Revival

The recovery was kickstarted by an unprecedented monetary stimulus that was much larger than during the Global Financial Crisis. Balance sheets of the G4 central banks as a percentage of GDP have increased 1.5 times to 58%. The remarkable speed at which Covid-19 vaccines were developed and rolled out has allowed economies to reopen. The following chart shows that life has almost returned to normal in several developed countries.

The remarkable speed at which Covid-19 vaccines were developed and rolled out has allowed economies to reopen. The following chart shows that life has almost returned to normal in several developed countries.

The Great Moderation

The Great Moderation

The annual GDP growth of 6-8% in 2021 will be a thing of the past as we progress beyond the low-base effects. The International Monetary Fund (IMF) forecasts GDP growth of 4-5% in 2022 and 2-3% in 2023.

The U.S. economy is on a solid footing. Consumers are in good shape, job openings are 1.5 times pre-Covid levels, total compensation has grown 3.7%, far exceeding historical numbers, and consumer savings have spiked sharply during the past two years.

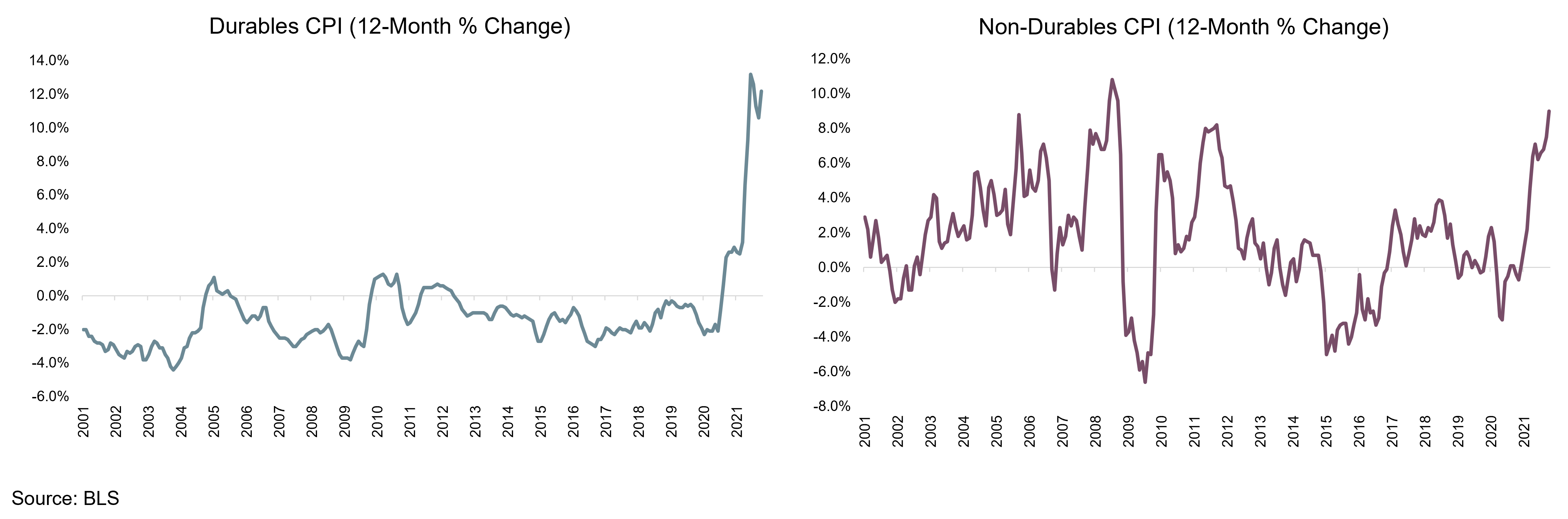

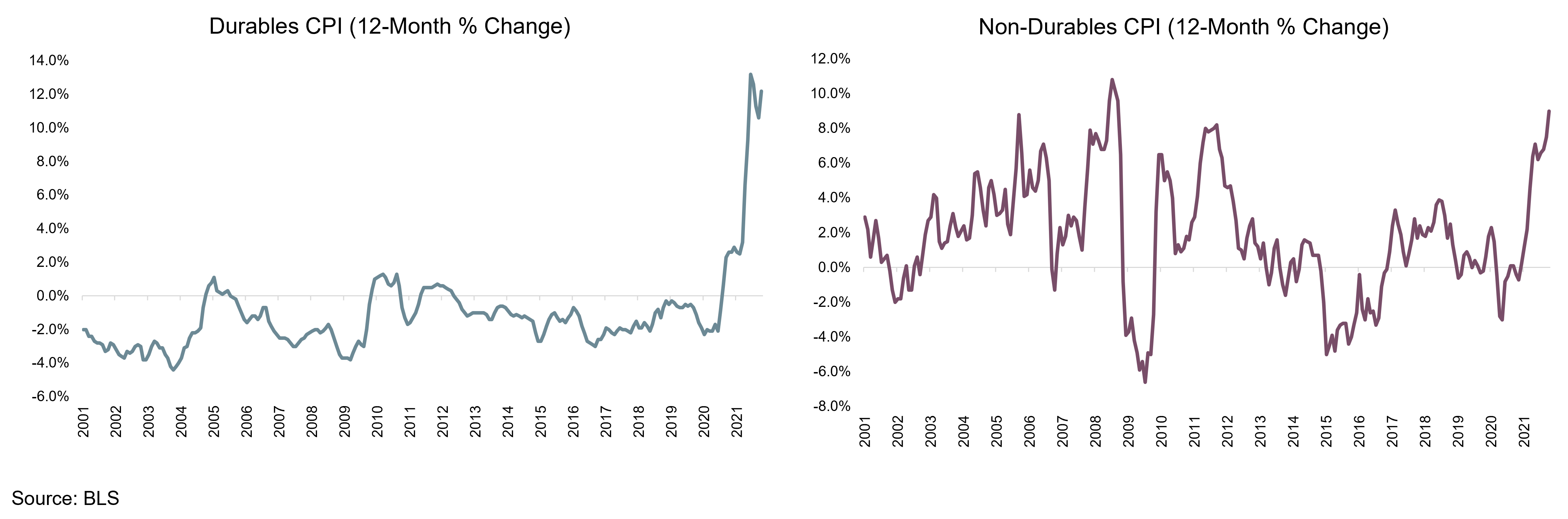

However, a few clouds are on the horizon. The first is inflation, with the U.S. core Consumer Price Index (CPI) at 30-year highs. A critical driver of the inflationary spike has been a shift in spending from services or consumable goods to durable goods (bicycles, home appliances, furniture, consumer electronics).

The following charts show a sharp spike in durables CPI, which is traditionally stable. As we emerge from the pandemic, this trend should reverse, along with supply chain disruptions.

Although inflation and supply chains will prove to be "long-term " transitory, investors should factor in inflation risk in portfolio construction.

In summary, the macroeconomic picture continues to look healthy. The following recession indicators that we follow show no sign of double-dip recession.

Risks and Returns in the New Moderation Regime

Risks and Returns in the New Moderation Regime

Our team studied the historical risk and returns of asset classes during the acceleration phases and compared them to phases of moderation. Public market returns should compress heading into the moderating growth phase of the cycle. Meanwhile, volatility is expected to be higher. As an example, the S&P 500 index averaged 18% annualized returns in the acceleration phase and 7% annualized in the moderation phase with the average drawdown being 10% in the acceleration phase and close to 12% in the moderation phase.

We remain convinced that private markets offer better risk-adjusted opportunities than public markets. For instance, yields continue to be compressed in the fixed-income market, with U.S. 10-year treasuries trading at negative real yields and corporate bonds yielding less than 3% in real terms. A similar picture appears in public equities with price-to-earnings multiples near record highs. Ned Davis Research (NDR) projects that U.S. equities will produce a 10-year annualized return of 5.6% while the average long-term historical return on public equities is close to 7%.

A similar picture appears in public equities with price-to-earnings multiples near record highs. Ned Davis Research (NDR) projects that U.S. equities will produce a 10-year annualized return of 5.6% while the average long-term historical return on public equities is close to 7%.

Meanwhile, private market opportunities continue to look attractive. Adding alternative investments to a traditional balanced portfolio, therefore, can deliver better investment returns, and this outperformance should be sustainable as skilled managers continue to leverage their expertise to capitalize on inefficiencies. Our team is able to identify opportunities and be paid for illiquidity premium, especially on the private equity side, and generate attractive cash yield in real estate equity and real estate debt.

Meanwhile, private market opportunities continue to look attractive. Adding alternative investments to a traditional balanced portfolio, therefore, can deliver better investment returns, and this outperformance should be sustainable as skilled managers continue to leverage their expertise to capitalize on inefficiencies. Our team is able to identify opportunities and be paid for illiquidity premium, especially on the private equity side, and generate attractive cash yield in real estate equity and real estate debt.

The equivalent of a balanced portfolio with 40% fixed income and 60% public equities in the private markets is expected to generate a nominal return of 8.2% or 6.2% in real terms (see chart below). Private equity is expected to be the largest contributor of return in a diversified private markets portfolio, hence our overweight to this asset class in a diversified private markets portfolio. Petiole has been building a customized private markets portfolio across sectors, geographies, and top-tier sponsors globally. Contact us to learn more.

Petiole has been building a customized private markets portfolio across sectors, geographies, and top-tier sponsors globally. Contact us to learn more.

The Great Revival

The Great Revival The remarkable speed at which Covid-19 vaccines were developed and rolled out has allowed economies to reopen. The following chart shows that life has almost returned to normal in several developed countries.

The remarkable speed at which Covid-19 vaccines were developed and rolled out has allowed economies to reopen. The following chart shows that life has almost returned to normal in several developed countries. The Great Moderation

The Great Moderation

Risks and Returns in the New Moderation Regime

Risks and Returns in the New Moderation Regime A similar picture appears in public equities with price-to-earnings multiples near record highs. Ned Davis Research (NDR) projects that U.S. equities will produce a 10-year annualized return of 5.6% while the average long-term historical return on public equities is close to 7%.

A similar picture appears in public equities with price-to-earnings multiples near record highs. Ned Davis Research (NDR) projects that U.S. equities will produce a 10-year annualized return of 5.6% while the average long-term historical return on public equities is close to 7%. Meanwhile, private market opportunities continue to look attractive. Adding alternative investments to a traditional balanced portfolio, therefore, can deliver better investment returns, and this outperformance should be sustainable as skilled managers continue to leverage their expertise to capitalize on inefficiencies.

Meanwhile, private market opportunities continue to look attractive. Adding alternative investments to a traditional balanced portfolio, therefore, can deliver better investment returns, and this outperformance should be sustainable as skilled managers continue to leverage their expertise to capitalize on inefficiencies.  Petiole has been building a customized private markets portfolio across sectors, geographies, and top-tier sponsors globally. Contact us to learn more.

Petiole has been building a customized private markets portfolio across sectors, geographies, and top-tier sponsors globally. Contact us to learn more.