The e-commerce growth in China and the nation’s significant shortage of modern logistics facilities present attractive investment opportunities. With the expertise of strong local partners, investors can benefit from this supply-demand imbalance.

China’s Economy: Outperforming amidst a Global Crisis

China’s economy ended a tough 2020 in remarkably good shape, firmly poised to expand in 2021. According to China’s National Bureau of Statistics, Q4 2020 GDP grew much faster than expected at 6.5%. Following strict virus containment measures and policy stimulus, the economy has recovered steadily from a steep 6.8% slump in Q1 2020 at the outbreak of the pandemic. Domestic travel has almost returned to pre-pandemic levels while hotel occupancy has improved through the year. Moreover, Chinese exports grew faster than expected in December as coronavirus disruptions around the world fuelled demand for Chinese goods despite a more expensive Chinese currency. With GDP growth of 2.3% in 2020, China was the only major economy to avoid contraction as the world struggled to contain the pandemic.

Massive Shift to E-commerce

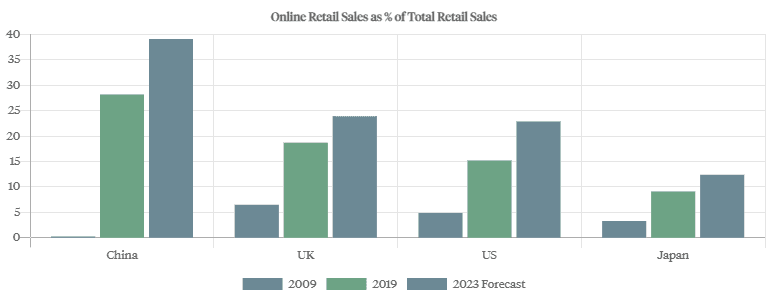

Although e-commerce penetration of retail sales in China had already surpassed mature economies like the United States over five years ago, local online sales profited enormously from the COVID-19 pandemic.

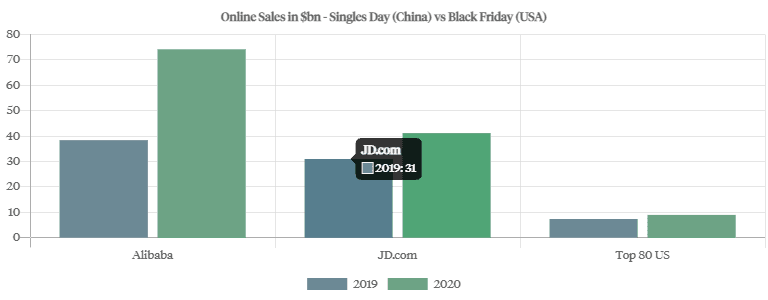

"Singles Day, the Chinese shopping holiday that takes place annually on November 11th, has become the largest online and offline shopping day in the world. The pandemic has accelerated the shift towards online sales, especially for basic household goods and groceries."

Thriving Online Penetration

With 128 cities and an average population of 4 million in each, urbanization has advanced significantly in China over the last decade, and continues to expand. The middle-class population has tripled since 2011 to around 222 million as disposable income per capita grew 170% from $2,285 in 2009 to $6,189 in 2019.

The Demand for Modern Logistics Facilities

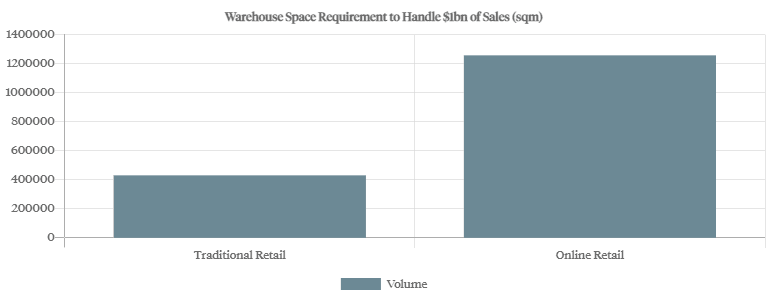

E-commerce disruptions have driven significant changes in supply chain management around the world. Online retail businesses need modern fulfillment and distribution centers near urban areas, expressways and airports.

"The facilities require exacting specifications for sufficient space, high ceilings, low density, loading platforms for cross-docking, etc. Online retailers, therefore, need three times more logistics space than traditional retailers"

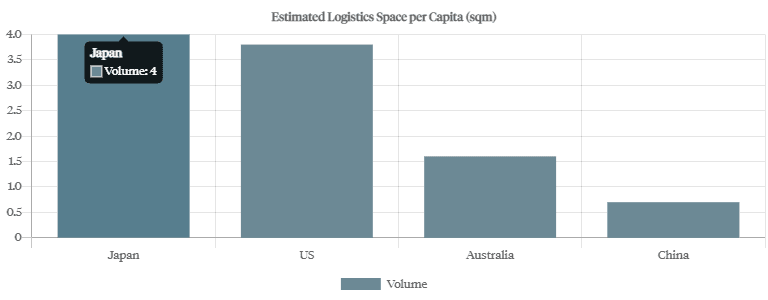

China’s logistics sector continues to benefit from a structural shift towards online retail but costs remain higher compared to other major economies. The cost of logistics is 8% of GDP in the US but 14.5% of GDP in China, due mainly to underdeveloped infrastructure and lower participation from third-party logistics players (3PL). The average stock turnover in modern warehouses is 9 days, compared to 60 days in substandard facilities. China’s estimated logistics space per capita of 0.7 square meters is less than 20% that of the US, approximately where the US was in 1967. Modern logistics facilities comprise just 4% of China’s warehouse stock (96% are substandard) while the US has 20 times this capacity.

The Chinese government has launched strategic initiatives to expand modern logistics facilities across the country. All major domestic banks are supportive and willing to fund this nationwide development with less restrictive terms (e.g.: interest rates, lending ratios, loan book size, etc.).

Access through Petiole

The accelerating e-commerce growth and shortage of modern facilities in China create promising investment opportunities. The Chinese government considers modern logistics facilities as essential infrastructure, and controls access to the land and the land listing process. Petiole has already invested in logistics real estate in China with reliable local partners, and is conducting due diligence to expand a modern logistics platform to about 30 assets across China.