The alliance of two European content powerhouses, Mediawan of France and Leonine of Germany, presents exciting investment opportunities as spending by streaming platforms rises to meet the surging demand for local premium content.

Accelerating Content Demand Fuels Streaming Wars

Amidst the COVID-19 pandemic last year, major over-the-top (OTT) [1] streaming platforms were launched, including Disney+, Apple TV+, and Peacock, and quickly dominated video consumption alongside PayTV and conventional broadcast services. The increased usage of smartphones, smart TVs and 5G boosted digital consumption and shifted global consumer preferences from traditional media to digital platforms. According to Park Associates, the average monthly US consumer spending on OTT services doubled from $8 in 2018 to $16 in 2020, while the Motion Picture Association noted that worldwide streaming subscriptions rose to more than $1.1 billion in 2020 from less than $400 million in 2016.

Structural Growth in the European Content Market

As the US market became saturated and global viewers sought more locally relevant content, streaming giants like Netflix, Amazon, and Disney allocate billions of dollars to produce original content overseas, targeting the masses of potential international subscribers.

In 2020, Netflix became the largest producer of original content in Europe, which prompted regulations on global OTT players in the region to protect established local broadcasters and distributors. The Audiovisual Media Services Directive allows each European country to implement laws that require OTT platforms to spend up to 30% of their revenue on the production of local original content, with France expected to be among the first in Europe to enact legislation that would require OTT players to spend 25% and grow from €50 million in 2019 to €400 million by 2024 in digital platform spending. Similarly, demand for local content in Germany is growing as US content becomes less relevant to German viewers.

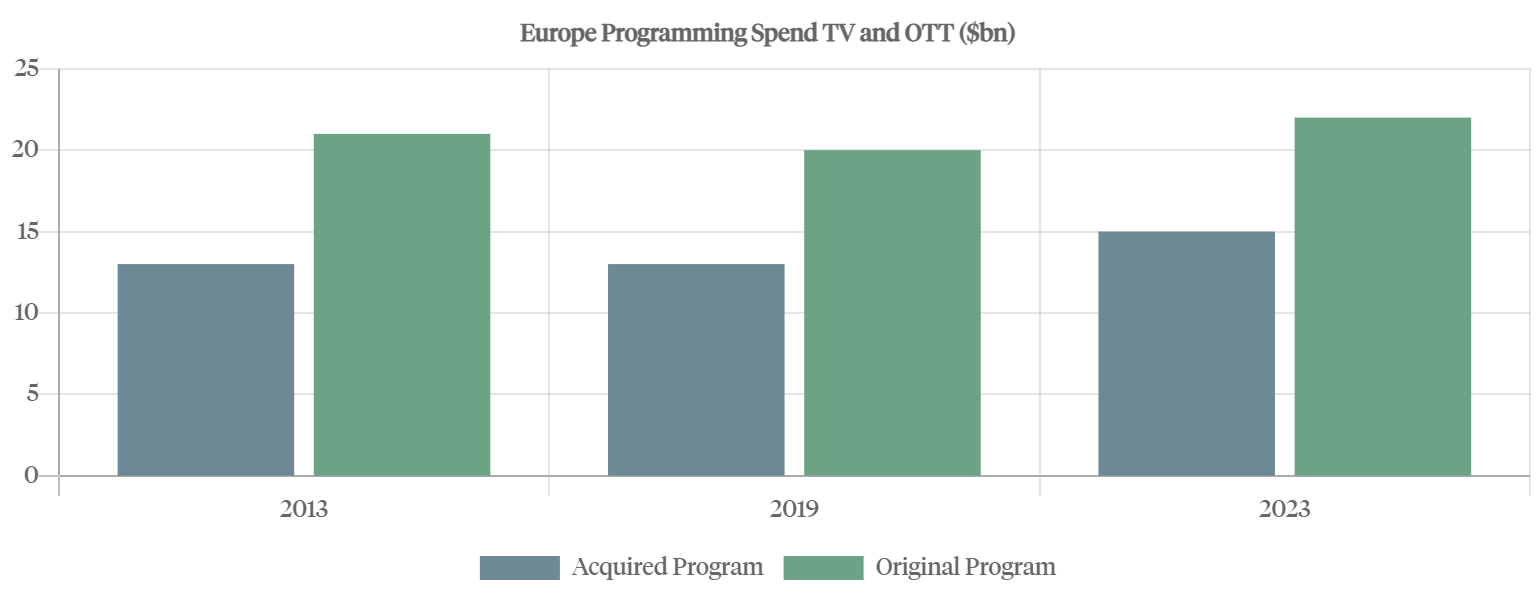

The rise in audio-visual content consumption, fragmented demand, and growing interest in local content is accelerating production globally and in Europe. Mediawan & Leonine Studios

Mediawan & Leonine Studios

Against a backdrop of surging demand, massive spending, and regulatory tailwinds, Petiole invested alongside KKR in the alliance of Mediawan and Leonine, clear market leaders in France and Germany respectively, to establish a leading European content platform.

TV production in France is quite fragmented across more than 20 production houses. Mediawan has been a leading independent French content platform operating the entire value chain including producing, distributing, and publishing audio-visual content across Europe, and is best known for producing the hit Netflix show Call My Agent. Through mergers and acquisitions, Mediawan owns strong brands in France, Italy, Spain, the Netherlands, Finland, and Senegal. The company leads in the number of hours produced for TV movies and series, and with its leading capabilities, strong reputation and high-quality shows, Mediawan is well-positioned to achieve above-market growth. Source: KKR

Source: KKR

Back in 2019, Petiole co-invested with KKR in the consolidation of four leading German media companies - Tele München Group, Universum Film, Wiedemann & Berg Film, and Information & Unterhaltung TV Produktion - to form the company Leonine, an integrated content production, distribution, and licensing company that is best known for the highly praised Netflix original series Dark.

The combined portfolio of 61 production houses in Europe will internationally expand the development of intellectual property (IP) through co-productions and co-financings. The consolidated platform will attract more talent and develop a stronger library of rights, allowing Mediawan and Leonine to co-finance more productions in-house and retain profitable IP rights.

Mediawan and Leonine collaborate on European and international co-production, theatrical production, licensing, and animation. Together, they already have 500-600 hours of annual fiction production, 2,000 hours of non-fiction production and more than 500 creative talents.[2]

Unlimited Content Consumption and Spending

The rapid trend towards online media consumption has only been accelerated by COVID-19 lockdowns and stay-at-home orders. A London-based research company predicts spending of $250 billion on content from global streaming services by end of 2021.

In addition, the pandemic has demonstrated that content demand is non-cyclical while content consumption is counter-cyclical. Daily online content consumption worldwide has spiked since the start of COVID-19, driven largely by OTT platforms.

Despite speculation that the industry may be near its peak in terms of content, the boom in the number of streaming services and their users is only accelerating the industry growth further with ample opportunities for expansion.

[1] OTT is any online content provider that offers streaming through the internet. Examples include Netflix, Hulu, Amazon Prime Video.

[2] Variety. Keslassy, Elsa. July 8 2021

Interested in learning more?