Why the Value of Private Market Investments Could Remain Stable

Given that valuations in public markets – excluding technology companies – corrected significantly over 2022, it might be assumed that valuations in private markets might also come down. However, that does not appear to be happening, and there are reasons to believe that prices in private markets will remain broadly stable.

While buyers may have reassessed the price they are willing to pay for a company – based on factors such as public comparables, precedent transactionsor discounted cashflow – sellers remain reluctant to lower their expectations. Some buyers are holding out in the belief that prices in private markets will adjust down, perhaps late this year, if the global economy remains flat or even falls into recession.

JPMorgan and others are among those who believe that valuations of private companies may be too high or are coming down.[i] That is, of course, a possibility. But it is also possible that prices in private markets will not fall. That, at least, is what history suggests. Despite some spectacular failures, privately owned companies as a whole held their value through the 2000s dotcom bust and after the 2008 financial crisis, according to a study published by the private-markets business Hamilton Lane.[ii]

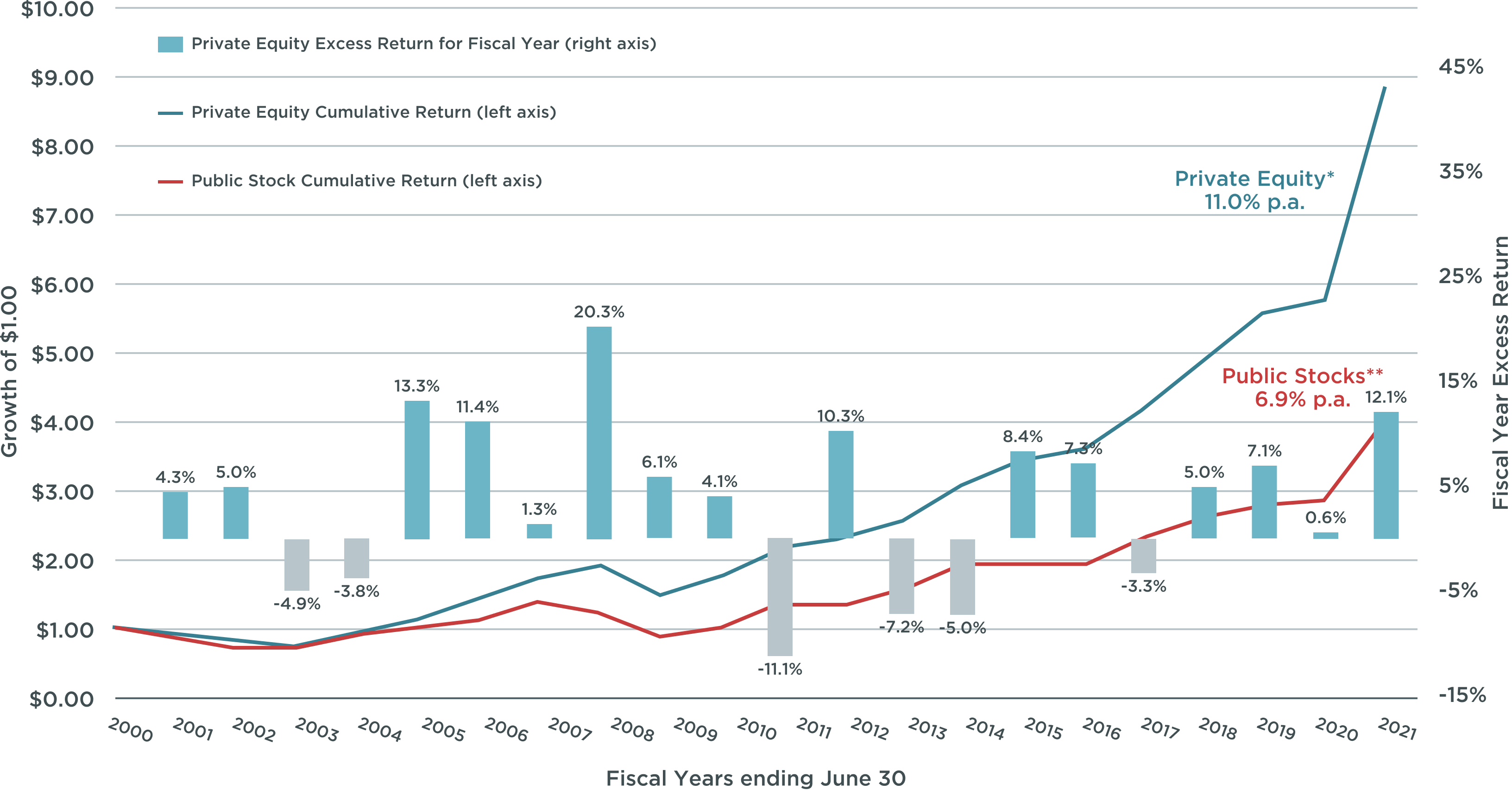

Another report, published by the Chartered Alternative Investment Analyst Association, confirms the outperformance of private equity over the economic cycle (see Figure 1). It found that:

“Over a 21-year time period ending June 30, 2021, private equity allocations by state pensions produced a 11.0% net-of-fee annualized return, exceeding by 4.1% the 6.9% annualized return that otherwise would have been earned by investing in public stocks.”

Figure 1: Private equity has outperformed public markets over two decades of the economic cycle

Conservative approach supports valuations

There are also reasons to believe most private-equity holdings are appraised conservatively and should hold their value, according to the data on deals and exit prices actually realised. Even in the challenging year of 2022, when public markets fell sharply, private-equity funds were generally able to sell their portfolio companies at prices above their book value as of the last prior valuation date. The exit premium, on average, amounted to more than 20% above the valuation four quarters prior to the sale, according to data from Hamilton Lane and Kaiser Partner Privatbank.[i]

The outperformance of private equity over its public counterpart reflects strong fundamentals. Privately held companies, for example, tend to grow much faster than publicly traded corporations in the long run. Revenues at the former have grown around 4 percentage points per annum more over the last 20 years than the latter, according to Kaiser Partner Privatbank. This could reflect a number of factors, including the ability of private businesses to take a longer-term view.

The ability to drive through operational improvements, which generally leads to a (substantial) boosting of profit margins, also explains the resilience of prices among private businesses. Even amid the especially tough climate that prevailed in 2022, companies owned by private-equity firms achieved a better business performance on aggregate than publicly traded corporations. According to data from Hamilton Lane, their revenue grew by 11% year-on-year for the first three quarters of 2022 (compared with 8% for publicly traded companies) and their EBITDA increased by 6% (3%).[ii]

The better operational performance of private firms reflects the standard private-equity model of buying businesses and then, after achieving a rapid performance improvement, selling them. This is achieved by following various practices, including: offering significant incentives to both private-equity portfolio managers and the operating managers of businesses in the portfolio; the aggressive use of debt, which provides financing and tax advantages; a determined focus on cash flow and margin improvement; and freedom from restrictive public-company regulations.

Key takeaways

History suggests privately-owned companies will hold their value – that was certainly the experience of the 2000s dotcom bust and the 2008 financial crisis.

Most private-equity holdings are also likely priced conservatively, according to the data on deals and exit prices actually realised.

Operational improvements, which generally lead to a (substantial) boosting of profit margins, should also support the price of private businesses.

[1] Financial Times

[2] Hamilton Lane

[3] Kaiser Partner Privatbank AG

[4] Kaiser Partner Privatbank AG

Disclaimer

The statements and data in this publication have been compiled by Petiole Asset Management AG to the best of its knowledge for informational and marketing purposes only. This publication constitutes neither a solicitation nor an offer or recommendation to buy or sell any investment instruments or to engage in any other transactions. It also does not constitute advice on legal, tax or other matters. The information contained in this publication should not be considered as a personal recommendation and does not consider the investment objectives or strategies or the financial situation or needs of any particular person. It is based on numerous assumptions. Different assumptions may lead to materially different results. All information and opinions contained in this publication have been obtained from sources believed to be reliable and credible. Petiole Asset Management AG and its employees disclaim any liability for incorrect or incomplete information as well as losses or lost profits that may arise from the use of information and the consideration of opinions.

A performance or positive return on an investment is no guarantee for performances and a positive return in the future. Likewise, exchange rate fluctuations may have a negative impact on the performance, value or return of financial instruments. All information and opinions as well as stated forecasts, assessments and market prices are current only at the time of preparation of this publication and may change at any time without notice.

Duplication or reproduction of this publication, in whole or in part, is not permitted without the prior written consent of Petiole Asset Management AG is not permitted. Unless otherwise agreed in writing, any distribution and transmission of this publication material to third parties is prohibited. Petiole Asset Management AG accepts no liability for claims or actions by third parties arising from the use or distribution of this publication. The distribution of this publication may only take place within the framework of the legislation applicable to it. It is not intended for individuals abroad who are not permitted access to such publications due to the legal system of their country of domicile.

Let’s build your bespoke solution

We can create tailor-fit portfolios that suit various investment strategies and risk profiles. Our private market specialists would be delighted to explore with you your investment needs.