The Myth of the Perpetual Winner

While investors often focus on headline-grabbing industries, the sectors that actually dominate markets shift over time, and not always in line with the popular story.

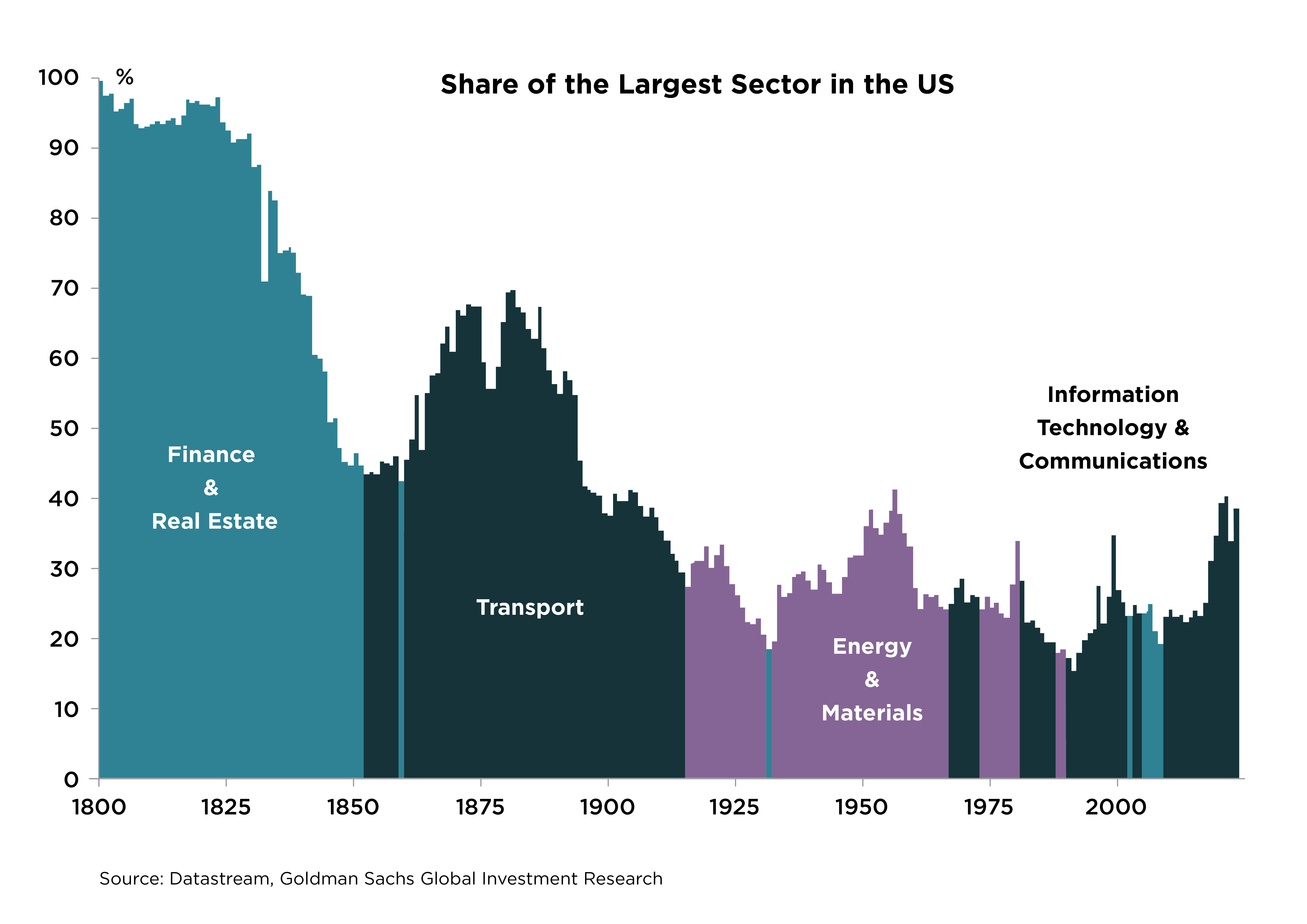

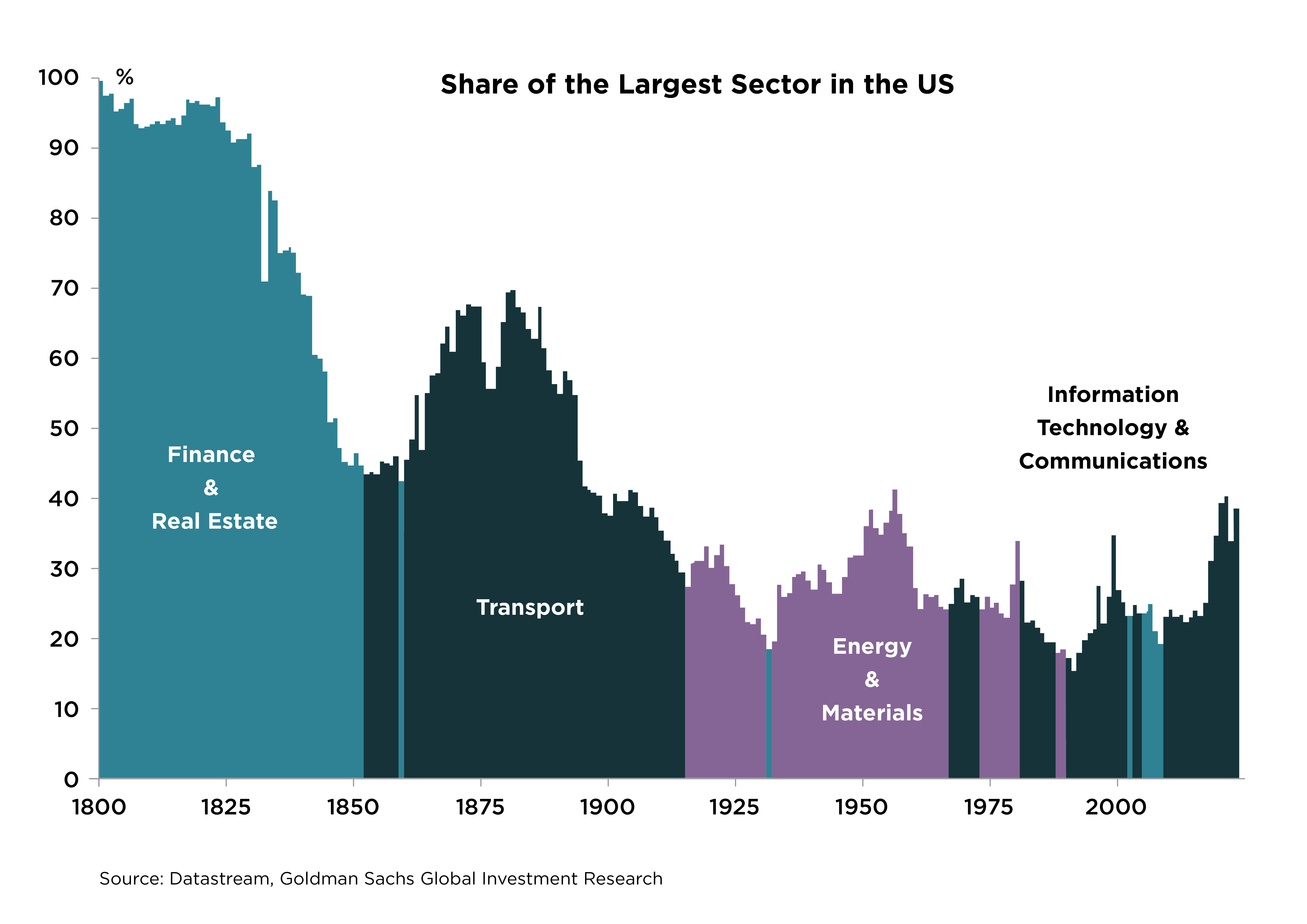

A chart from Goldman Sachs illustrates this clearly[1]: in the 1800s, finance and real estate held the largest market share. By the early 1900s, transport had taken over. Mid-century saw energy and materials at the top, and today, it’s information technology and communications.

Sectors that dominate the headlines don’t always deliver strong long-term returns. History shows that when investors chase popular narratives, they often overpay, leading to poor outcomes when the hype fades. From Canal Mania in the late 1700s to the Internet Bubble of the early 2000s, the most celebrated sectors of their time often ended in disappointment.

Sectors that dominate the headlines don’t always deliver strong long-term returns. History shows that when investors chase popular narratives, they often overpay, leading to poor outcomes when the hype fades. From Canal Mania in the late 1700s to the Internet Bubble of the early 2000s, the most celebrated sectors of their time often ended in disappointment.

Concentrating in a single sector, even a promising one, can increase risk. History suggests that these concentrated bets often fall short over time.

Volatility in Sector Performance

Investors often rely on recent performance as a guide, assuming that last year’s best-performing sector will continue to lead. But historical returns show that sector leadership changes frequently and unpredictably.

This trend is reflected in sector performance tables, where different sectors rotate between the top and bottom each year, with little consistency. Technology may lead one year and lag the next, while less prominent sectors like utilities or consumer staples quietly outperform during downturns.

This volatility shows how difficult it is to time sector bets successfully. Even professionals struggle to predict which industries will lead in any given year. Instead, maintaining exposure to a range of sectors allows investors to participate in growth wherever it occurs, without relying on forecasts or trends.

Stock market returns are also often driven by a small number of exceptional performers. Just a few standout companies can account for most of the market’s overall gains. Missing these top performers can significantly drag down returns. The only reliable way to make sure you benefit from them is through broad and consistent diversification.

The Power of Diversification

A diversified portfolio doesn’t just reduce the risk of being wrong, it increases the chance of being right somewhere. By spreading investments across sectors, investors benefit from the strengths of multiple industries while minimizing the impact of any single sector's decline. Relying on a single industry carries a deeper risk: if that sector suffers a major downturn, there’s no guarantee it will ever recover. Some industries fade or become obsolete entirely.

Concentrated portfolios also tend to rise and fall sharply, often triggering emotional decisions like panic selling during downturns or chasing returns after rallies. Broad sector exposure smooths performance, helping investors stay invested through cycles and stick to their long-term plans. This emotional resilience can be just as important as financial performance in achieving lasting success.

How Petiole Helps Investors Diversify Intelligently

At Petiole, sector diversification is a core principle of our investment strategy. We don’t rely on market trends or concentrate exposure in a single industry. Instead, our strategies are intentionally spread across a range of sectors to reduce risk and capture opportunities wherever they emerge.

This disciplined approach helps avoid the pitfalls of concentrated bets, where a single downturn can derail long-term performance, especially if a sector fails to recover or becomes obsolete. By diversifying thoughtfully, we give our investors the best chance of holding long-term winners thereby significantly enhancing the reliability of long-term returns.

Conclusion

The question is not which sector will lead next, but whether your portfolio is prepared for whichever one does. In a world where market leadership shifts and certainty is fleeting, the strength of an investment strategy lies in its balance.

At Petiole, we don’t chase trends. We curate access to private market opportunities designed to grow steadily, withstand change, and support our clients’ ambitions with clarity. With over 20 years of investing experience across market cycles, our team brings the insight and discipline needed to help investors navigate complexity and pursue their long-term goals with confidence.

[1] Goldman Sachs

Sectors that dominate the headlines don’t always deliver strong long-term returns. History shows that when investors chase popular narratives, they often overpay, leading to poor outcomes when the hype fades. From Canal Mania in the late 1700s to the Internet Bubble of the early 2000s, the most celebrated sectors of their time often ended in disappointment.

Sectors that dominate the headlines don’t always deliver strong long-term returns. History shows that when investors chase popular narratives, they often overpay, leading to poor outcomes when the hype fades. From Canal Mania in the late 1700s to the Internet Bubble of the early 2000s, the most celebrated sectors of their time often ended in disappointment.