Building Resilient Portfolios Beyond Public Markets in 2026

The current landscape of public markets is filled with uncertainty that feels markedly different from previous periods. Elevated interest rates, persistent geopolitical risks, and rapidly changing market sentiment have created an environment where volatility is no longer an anomaly, but an inherent part of the market’s baseline.

For many years, the 60/40 portfolio model served as a stable approach to managing market uncertainty. Equities provided growth, bonds offered balance, and diversification provided additional risk mitigation. This model functioned well in an era of falling interest rates and abundant liquidity. However, as we enter 2026, the limitations of this approach are becoming more apparent.

The Limitations of Traditional Diversification

The traditional 60/40 portfolio is based on the assumption that stocks and bonds will behave differently in times of market stress. However, this relationship has weakened in recent years. Rising inflation and coordinated central bank actions have caused the correlation between equities and bonds to increase, diminishing the protective effect of diversification.

Studies show that during periods of rate shocks, both asset classes can move in the same direction, leaving portfolios more vulnerable than anticipated.[1]

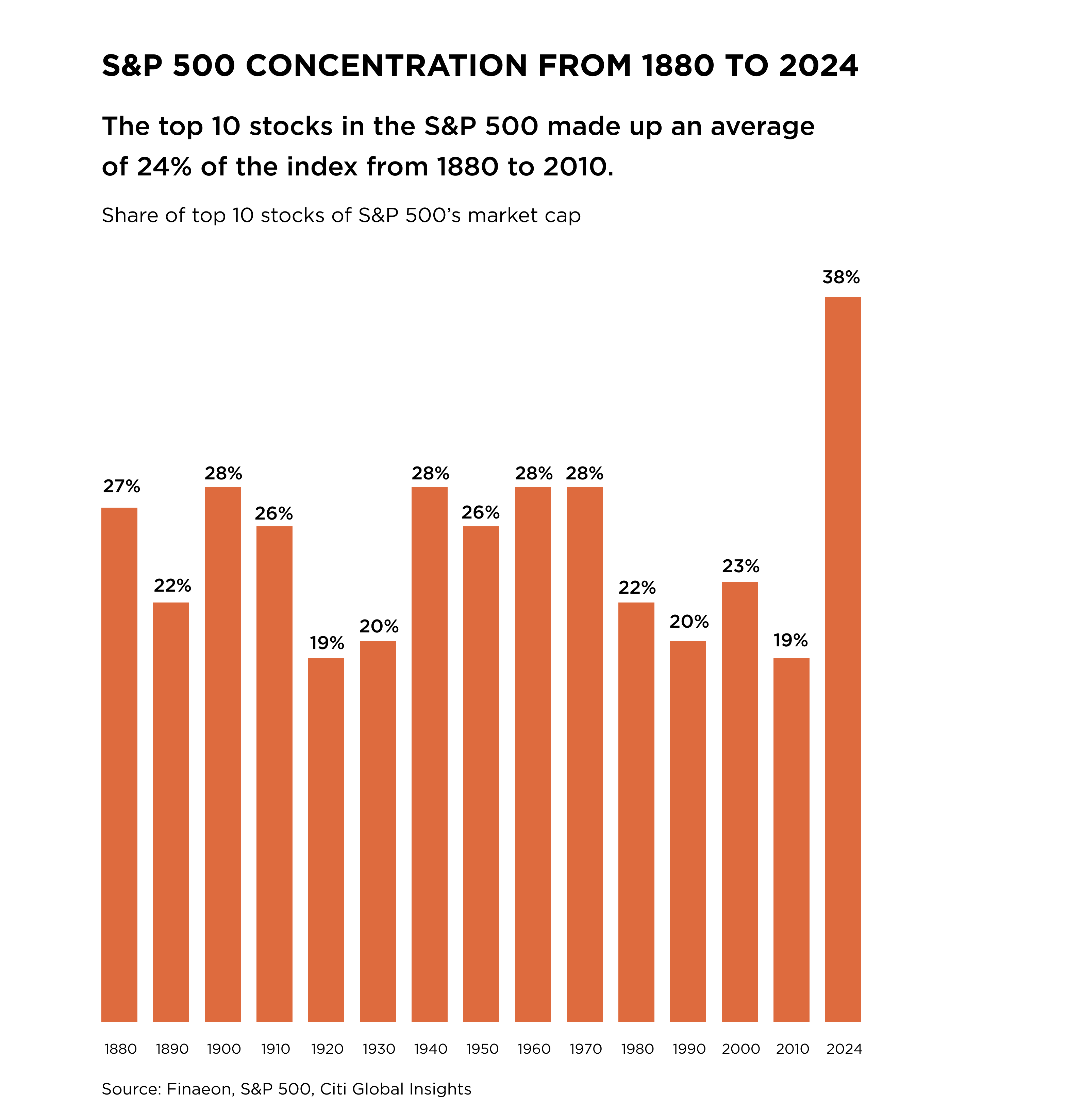

At the same time, public markets have become more concentrated, with a small group of large companies, particularly in technology, dominating major equity indices. For example, the top 10 stocks in the S&P 500 account for nearly 38% of its total market capitalization, which means investors may perceive themselves as diversified when, in reality, they are exposed to similar growth drivers and risks.[2]

The Hidden Part of the Economy

An often-overlooked shift is the growing portion of the global economy that exists outside public markets. The number of publicly listed companies has decreased across major exchanges, while private companies are remaining private longer. Today, there are over 215,000 companies backed by private equity and venture capital, compared to around 8,800 companies in global public equity indices such as the MSCI ACWI Investable Market Index. This means there are nearly 25 times more private companies than public ones.[3]

Despite this scale, private markets represent a smaller share of total investable capital. These markets provide exposure to sectors that do not dominate public indices, such as industrial services, logistics, healthcare, infrastructure, and real estate. These sectors are tied to long-term trends driven by demand and execution, rather than short-term market sentiment.

How Value Is Created

A key distinction between public and private markets is how returns are generated. Public market returns are often driven by fluctuations in valuation multiples and investor sentiment. In contrast, private market returns typically arise from direct improvements within businesses, such as expanding operations, strengthening balance sheets, consolidating industries, or improving cash-flow stability.

Because private assets are not traded daily, performance is less influenced by market sentiment and more driven by underlying business fundamentals. Over extended periods, this distinction has proven significant.

That said, private markets are not without risk. Illiquidity, longer holding periods, and the importance of manager selection all play a role. However, risk in private markets is mitigated through structure, discipline, and active ownership rather than daily price movements.

The Importance of Access and Selection

Access to private markets is not straightforward. Top-tier managers often have limited capacity, high minimum investments, and substantial variation in fund performance. This creates an access gap, where institutional investors, such as pension funds and endowments, benefit from dedicated teams focused on sourcing, due diligence, and portfolio construction across private assets.

At Petiole, private markets are not viewed as isolated opportunities but are integrated into broader portfolios with defined objectives, pacing, and diversification across strategies and vintages. This approach makes private market strategies, typically available only to large institutions, accessible within a structured, disciplined framework.

This approach mirrors how leading institutions allocate capital. According to McKinsey’s 2025 Global Private Markets Report, approximately 30% of institutional investors surveyed plan to increase their allocations to private equity in the coming year. Many others also intend to allocate more capital to private market strategies overall, indicating sustained interest in private assets for long-term portfolios.[4]

A Practical Shift for the Future

As we enter 2026, it is clear that investors need a broader toolkit than what has served them in the past decade. Public markets continue to play a key role in providing liquidity and transparency, but relying solely on them could expose portfolios to concentrated risks and rising correlations.

Private markets offer a complementary strategy. They provide access to a broader economic base, different return drivers, and long-term value creation tied to businesses and assets.

This approach is not about chasing returns or abandoning public markets; it’s about modernizing portfolios to reflect the realities of today’s global economy.

At Petiole, we help investors build balanced portfolios with clarity, discipline, and institutional insight, ensuring they are well-positioned for the cycles ahead.

Let’s build your bespoke solution

We can create tailor-fit portfolios that suit various investment strategies and risk profiles. Our private market specialists would be delighted to explore with you your investment needs.