The 2024 Pension Adequacy Report from the European Commission warned that many future retirees may not achieve sufficient income levels without additional personal savings and investments.[1] Yet for many investors, bridging that gap remains a challenge, not just of willpower, but of access.

Too often, long-term investment strategies remain out of reach. Without consistent contributions and exposure to diversified asset classes, like private equity, private credit, infrastructure, and real estate, portfolios may struggle to withstand market volatility and deliver the long-term growth needed to meet future financial needs.

Bridging the Retirement Planning Gap

Across developed economies, many individuals are entering mid-career with significant earning power but insufficient retirement planning. In fact, only 36% of workers globally feel confident in their retirement savings strategy.[2] This gap often stems from limited access to tailored investment solutions and limited exposure to long-term compounding.

The emotional toll is also real. For a generation that views retirement as a stage to maintain, rather than downsize its lifestyle, the fear of falling short can create inaction. That’s where access to private markets can offer not just growth, but clarity.

The Rise of Private Markets

Private markets have historically been the domain of institutional investors, endowments, and ultra-high-net-worth individuals. Over time, they’ve consistently outperformed traditional public markets and provided insulation from short-term volatility.

Now, the landscape is shifting. Advances in digital platforms and investment structuring are opening up curated private market opportunities to a broader range of qualified investors.

Digital Access Meets Private Market Expertise

Global investment leaders are increasingly advocating for broader access to private markets. In his 2024 Chairman’s Letter, BlackRock CEO Larry Fink described this shift as a move toward “economic democracy,” where digital platforms open the door for more investors to access investment strategies once reserved for institutions.[3]

Petiole is helping lead this transition. As a FINMA-licensed asset manager with over 20 years of experience in private markets, we provide clients access to global co-investments and institutional funds through a digital platform built for today’s investor. Our approach combines curated deals with seamless onboarding, giving investors the tools to build globally diversified portfolios focused on long-term growth and stability.

Why Starting Early Matters

In retirement planning, time is more than just a variable; it’s leverage. The earlier consistent contributions begin, the greater the potential impact of compounding returns.

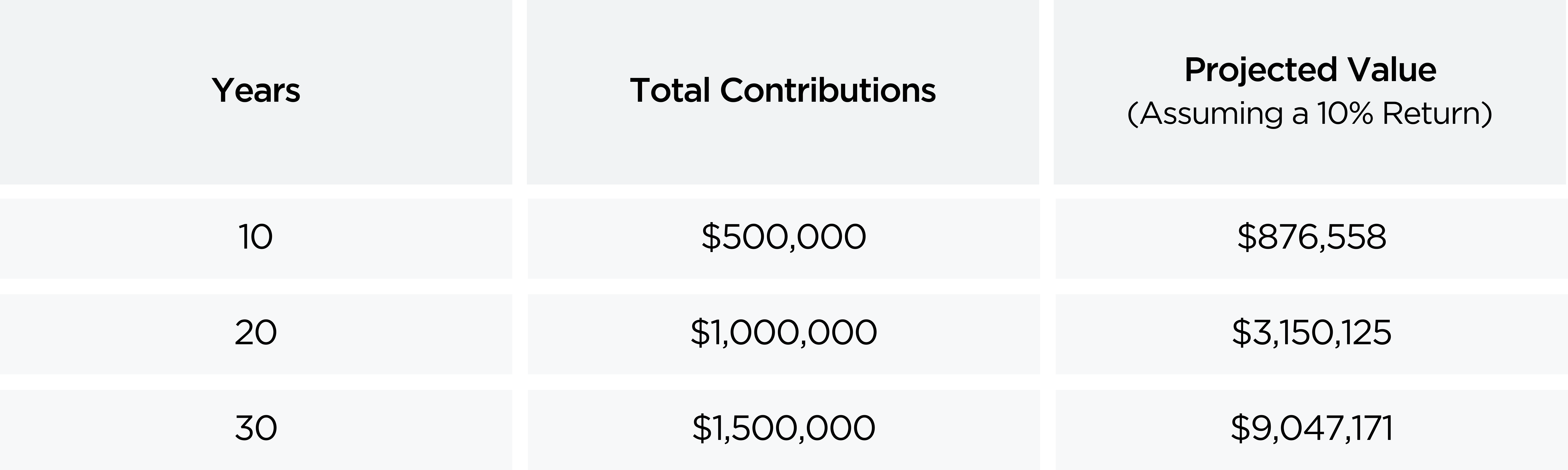

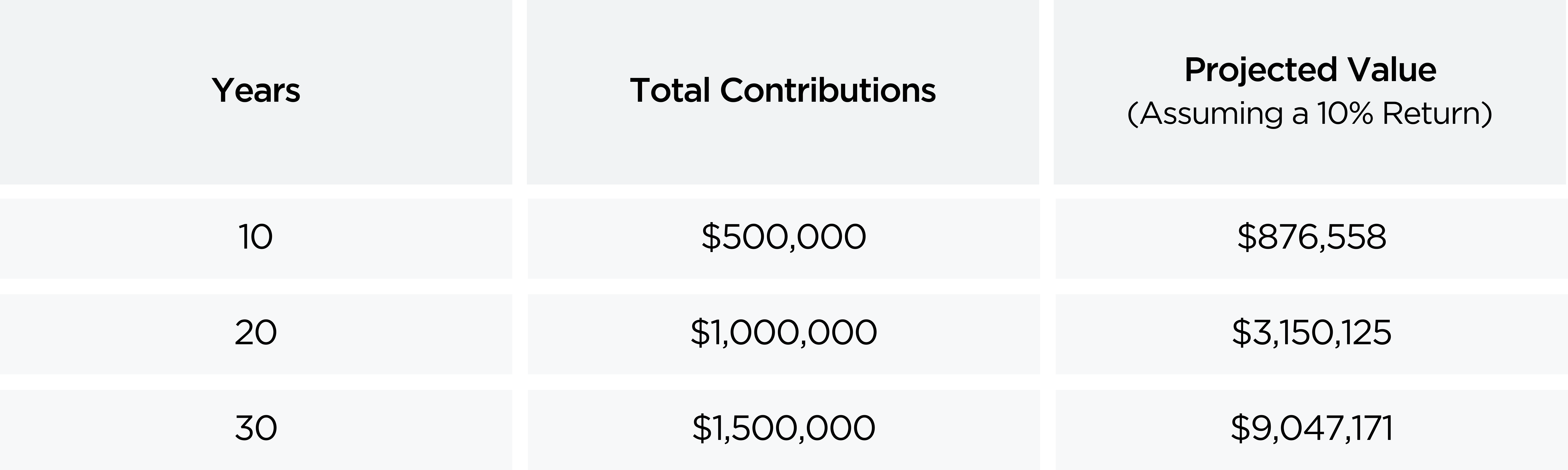

Consider the following projection for a 30-year-old investor contributing $50,000 annually into a diversified private market portfolio with a 10% target return:

The exponential growth in later years highlights why starting early makes a meaningful difference.

The exponential growth in later years highlights why starting early makes a meaningful difference.

Investing with Confidence

Whether your goal is early retirement, passive income, or long-term wealth preservation, private markets can play a pivotal role. At Petiole, we combine decades of global experience with a technology-first mindset to help investors create portfolios that evolve with their lives.

By embracing private markets as part of a disciplined retirement plan, investors can build a stronger foundation for their financial future, one that withstands volatility, capitalizes on long-term trends, and adapts to life’s changes.

[1] European Commission

[2] PwC

[3] BlackRock

The exponential growth in later years highlights why starting early makes a meaningful difference.

The exponential growth in later years highlights why starting early makes a meaningful difference.