According to the 2024 Swiss Life Self-Determination Barometer, only 46% of Swiss respondents feel confident about their financial situation ten years into the future, which is a notable decline from previous years. Furthermore, just 27% believe that their state and private pensions will enable them to lead a financially self-determined life in old age.[1]

This growing lack of confidence is driving a reevaluation of traditional financial strategies. As concerns deepen around the adequacy of public and private pension systems, many investors are questioning whether conventional models can still deliver long-term financial security. The long-favored 60/40 portfolio model (60% stocks and 40% bonds) is increasingly being called into question, and private market investments are stepping in as a powerful tool to support wealth preservation and sustainable retirement income.

Moving Beyond the 60/40 Portfolio

The 60/40 model, once the gold standard for balanced portfolios, relied on the inverse relationship between equities and bonds to reduce volatility. But in today’s environment of elevated inflation and synchronized rate movements, both asset classes can fall in tandem, exposing investors to greater risk.

In his 2025 annual letter, BlackRock CEO Larry Fink proposed a new framework: the 50/30/20 portfolio, allocating 20% to private markets.[2] This allocation reflects a growing institutional consensus that private assets are no longer optional; they're essential for diversification and long-term performance.

Why Private Markets Matter for Retirement Planning

Private markets include private equity, private credit, infrastructure, and real estate. These asset classes offer differentiated return sources, inflation-hedged income, and lower correlation to public markets.

Private Equity: Enables access to growth-stage businesses not available on public exchanges, with the potential for significant capital appreciation and an illiquidity premium.

Private Credit: Offers stable, contract-based returns and often includes asset-backed structures that provide downside protection.

Infrastructure: Long-term projects such as renewable energy, transportation, and digital infrastructure offer inflation-linked, predictable cash flows.

Real Estate: Provides steady income through rental yields and the potential for long-term capital appreciation, while serving as a natural hedge against inflation.

At Petiole, we focus on highly selective, global private market opportunities. Our strategy emphasizes risk-adjusted returns, robust due diligence, and long-term alignment with our clients’ financial objectives. Through access to institutional-grade investments, we help investors build portfolios that are more resilient and better equipped for future challenges.

The Advantage of Starting Early

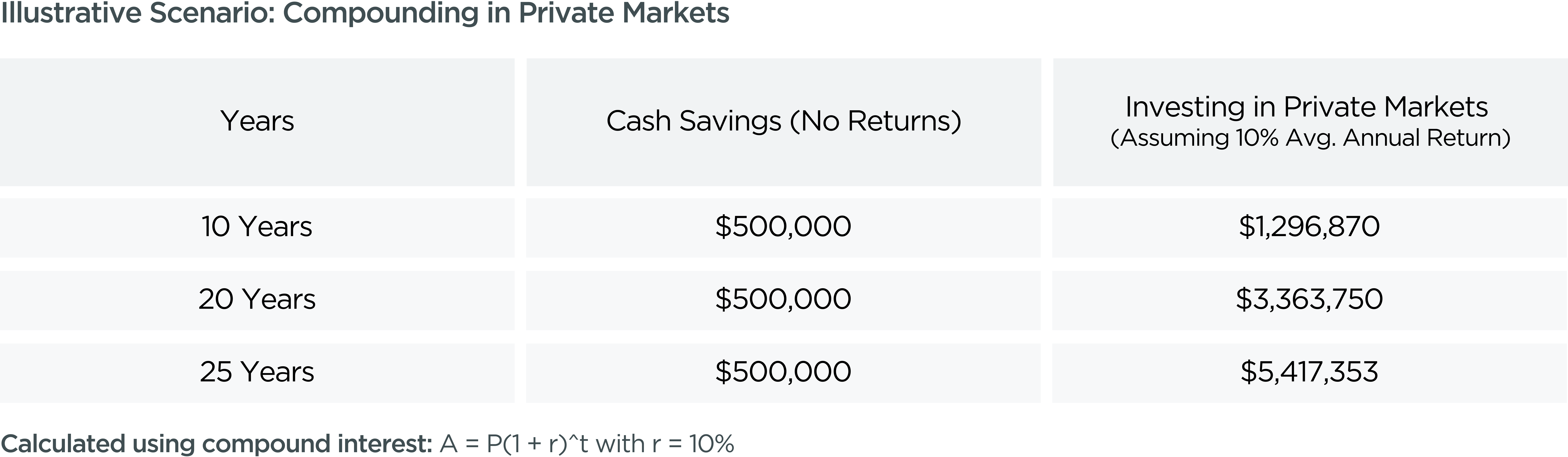

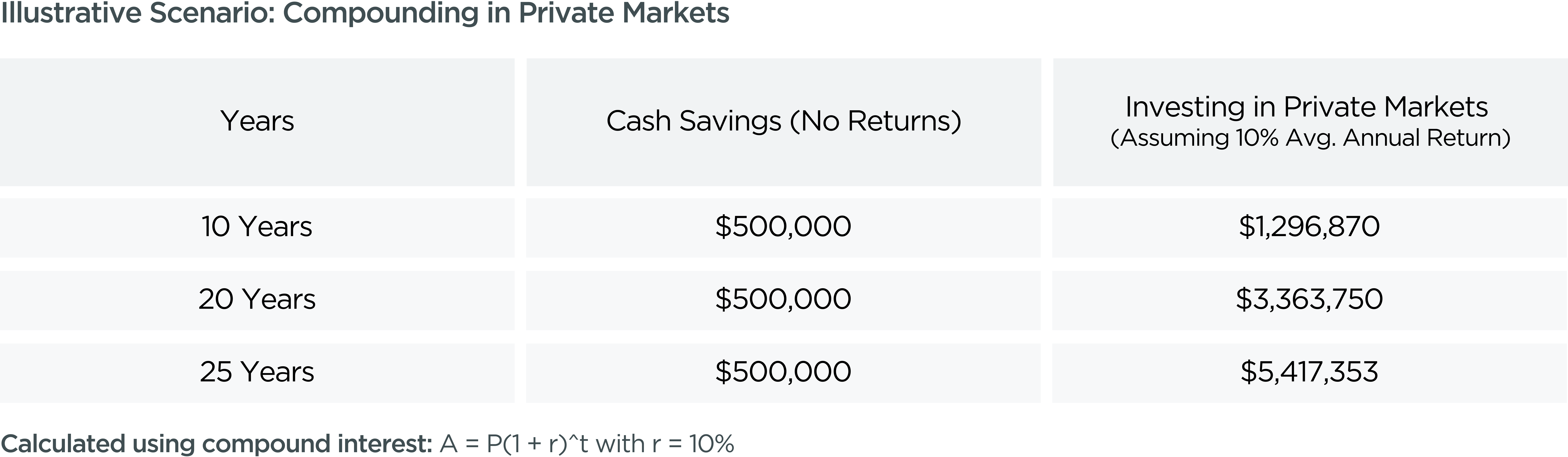

When planning for retirement, the timeline is one of the most powerful levers investors have. The earlier one gains exposure to private markets, the greater the potential for compounding and portfolio growth.

Unlike cash reserves, which may preserve nominal value but lose purchasing power over time, private market investments offer the opportunity to generate long-term returns that keep pace with or exceed inflation.

These figures highlight the stark contrast between passive saving and active investing. The earlier the commitment, the greater the reward.

These figures highlight the stark contrast between passive saving and active investing. The earlier the commitment, the greater the reward.

Start Planning with Petiole

Preparing for retirement demands more than just saving; it requires strategic investment planning tailored to long-term outcomes. At Petiole, we help investors design future-ready portfolios that leverage the strengths of private markets.

Speak to our team to explore how private market solutions can support your retirement goals.

[1] Swiss Life

[2] BlackRock

These figures highlight the stark contrast between passive saving and active investing. The earlier the commitment, the greater the reward.

These figures highlight the stark contrast between passive saving and active investing. The earlier the commitment, the greater the reward.