True success is measured not by short-term responses but by consistency and resilience, ensuring assets are preserved and grow over generations. This article explores how a structured, long-term investment strategy, based on diversification, discipline, and access to opportunities, can weather market volatility and help safeguard and grow assets across generations.

A resilient long-term investment strategy is built upon fundamental principles that inform decisions, shape objectives, and provide stability through market cycles. The following are the core components to consider:

1. Define Clear Objectives

A successful investment strategy begins with clearly defined financial goals. Whether the objective is asset preservation, maintaining liquidity, or preparing for future generations, having a clear purpose sets the foundation for an investment approach and guides every decision.

At Petiole, portfolio construction is driven by tailored strategies and planning, ensuring that each investment aligns with the unique objectives and needs of the investor.

2. The Necessity of Diversification

Diversification is key to managing concentration risk and minimizing exposure to market volatility. By distributing investments across various asset classes and geographical regions, investors can cushion against downturns in any single market. Including private markets, such as private equity, private credit, and real estate, further enhances diversification, as these asset classes tend to behave differently from public markets and offer opportunities that complement traditional investments. For example, in 2022, despite a slowing global economy and rising inflation, private markets only fell by 3.5%, while global equities faced double-digit declines, affecting both developed and emerging markets.[1]

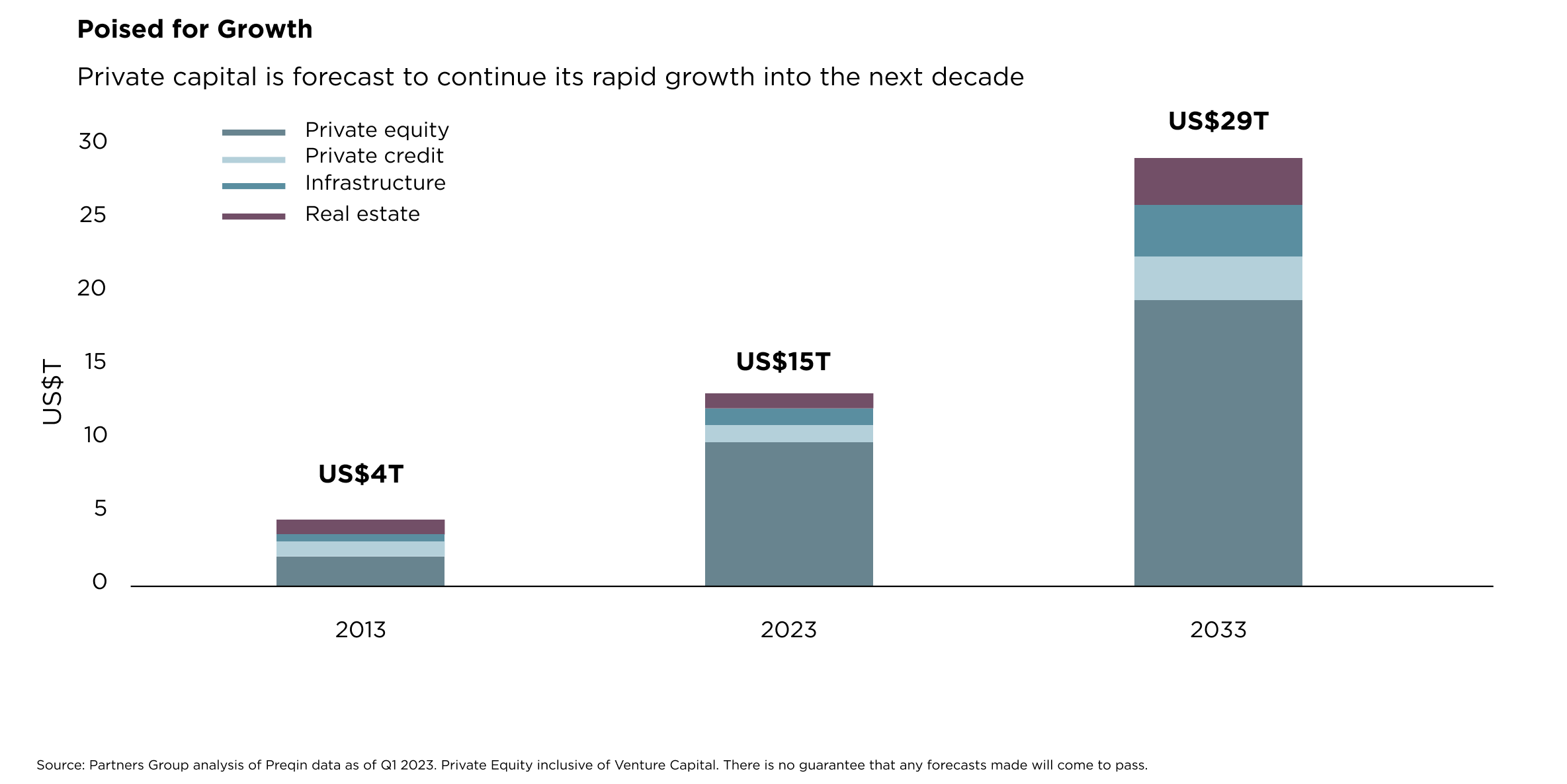

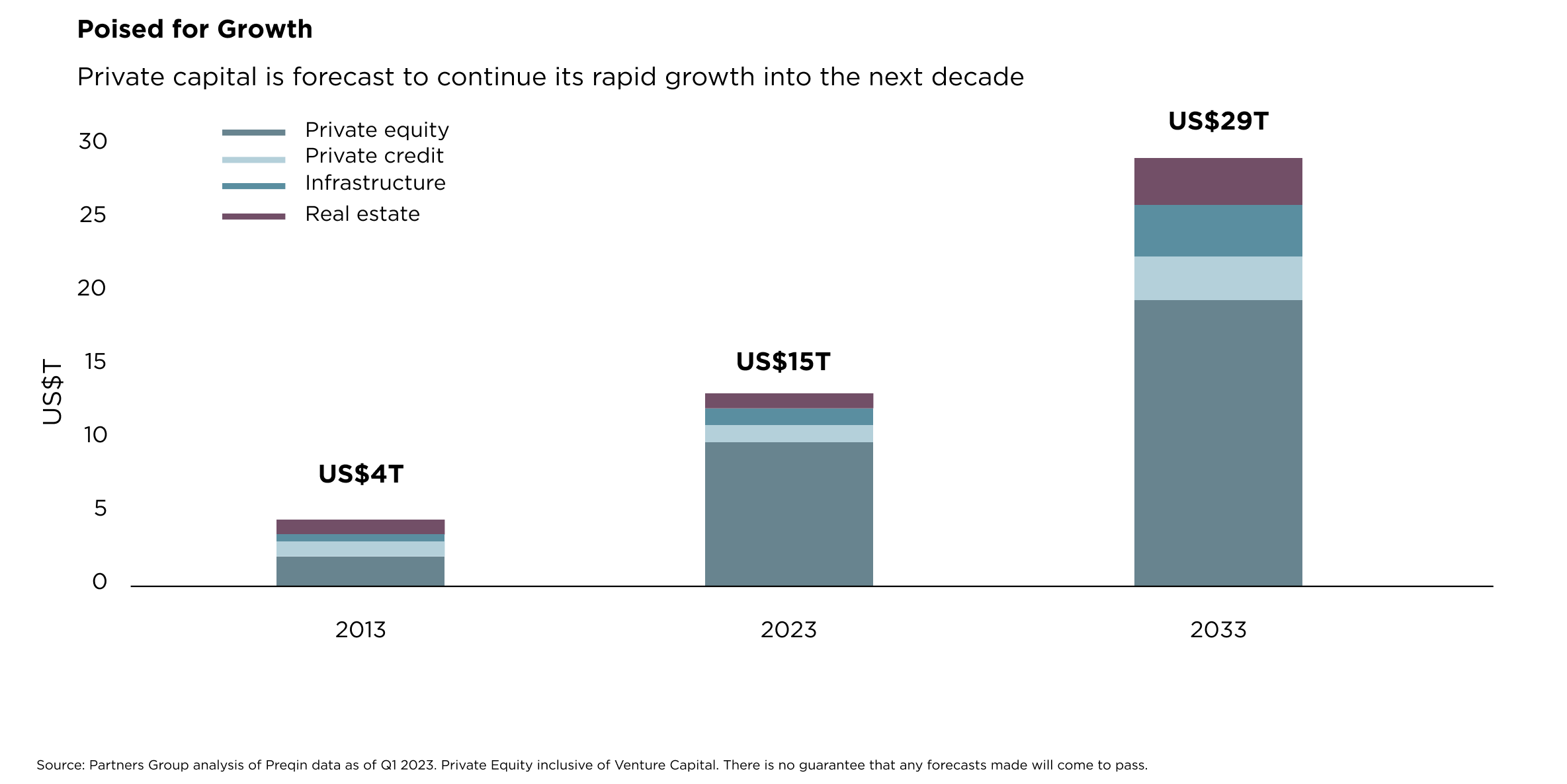

Private markets are also evolving rapidly, with private capital expected to grow substantially over the next decade, providing valuable opportunities for resilient long-term growth.

Petiole provides curated access to private market opportunities that are typically unavailable to individual investors, further enhancing portfolio resilience and growth potential.

3. Maintain Discipline Through Market Cycles

Emotional decisions can harm long-term performance, and reacting impulsively during market volatility can undermine carefully crafted strategies. Remaining disciplined throughout market cycles is critical.

Petiole plays an integral role in providing guidance and fostering confidence, helping professional investors stay on course during periods of uncertainty. By adhering to a disciplined approach, long-term objectives remain the focus, regardless of temporary market fluctuations.

4. The Importance of a Trusted Advisor

Even experienced investors benefit from expert advice, global access, and structured frameworks. As a long-term partner, Petiole provides tailored strategies and access to private market opportunities. This partnership strengthens disciplined decision-making and offers the expertise needed to navigate the complexities of modern financial landscapes.

Conclusion

Long-term investment success is rooted in foresight, resilience, and disciplined execution. By combining clear objectives, diversification, and professional guidance, investors can build strategies capable of enduring market cycles and safeguarding assets for future generations. Petiole works closely with professional investors to develop these strategies, ensuring that assets not only grow but stand the test of time.

[1] Ernst & Young