July Fed Meeting: Navigating Uncertainty Amid Global Shifts

At its June meeting, the Federal Reserve (the “Fed”) decided to maintain interest rates within the current range of 4.25% to 4.5%, and it is widely anticipated that the rates will remain unchanged during the upcoming meeting on July 29-30. [1]

Beyond this, there is limited clarity in both the markets and within the Fed itself, due to the significant global events and uncertainties shaping the economic landscape. This article examines the available data and aims to separate facts from speculation.

The June Meeting

The minutes from the Fed's most recent meeting, released earlier this month, revealed a clear division in opinion among Fed officials.[2] Governors Waller[3] and Bowman,[4] appointed by President Donald Trump, have expressed the view that the inflationary impacts from tariffs are likely to be temporary. If this proves true, rate cuts could be on the horizon.

However, the majority of officials seem to be concerned that the ripple effects of the ongoing trade negotiations could be more severe and long-lasting. As Fed Chairman Jerome Powell noted in the press conference, “Every outside forecaster, and the Fed itself, is saying that we expect a meaningful amount of inflation to arrive in the coming months”.[5]

The Fed consistently stresses that its decisions must be forward-looking, informed by the latest data. So far, the data does not suggest immediate concern. However, the key question is how relevant this historical data is when considering the unfolding trade situation.

The Latest Data

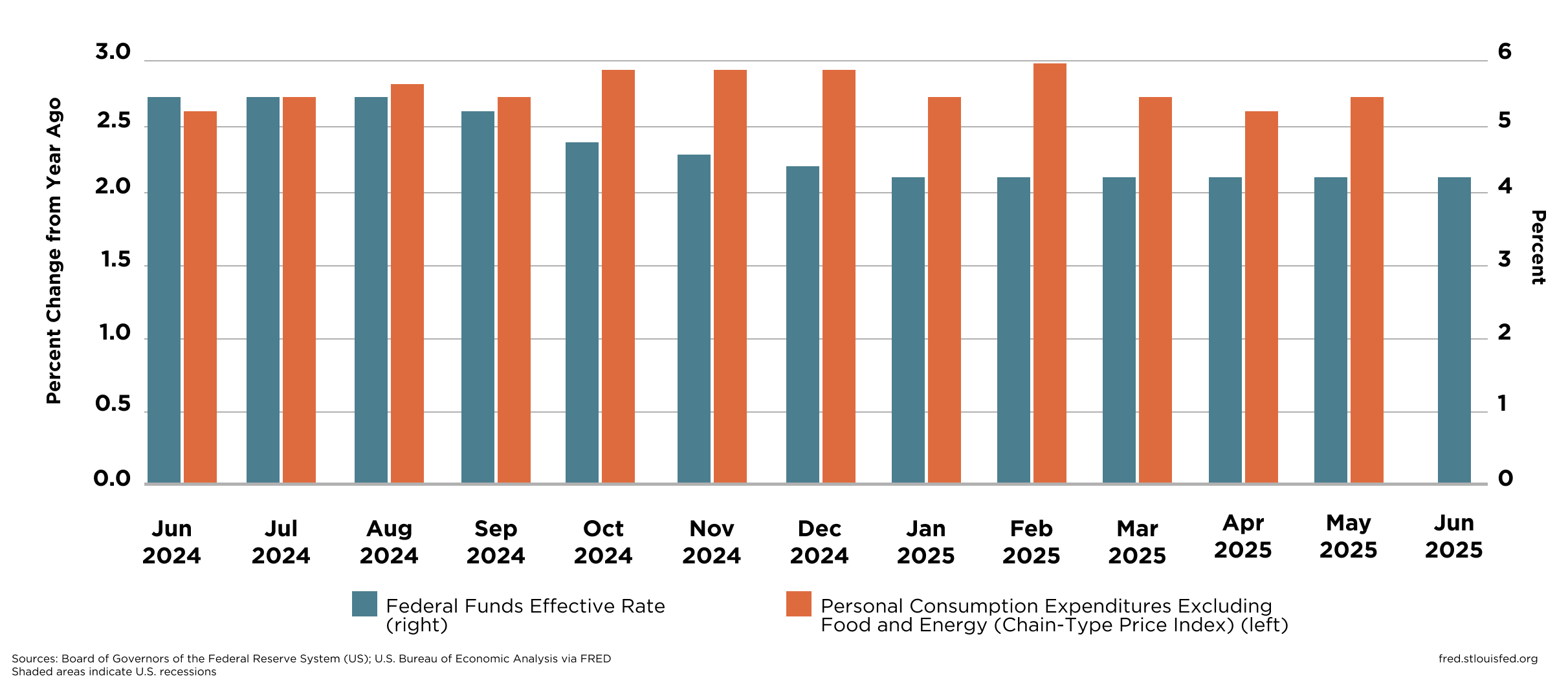

The Fed’s primary mandate is to control inflation and support the labor market. Both appear to be in a favorable position. The unemployment rate, already low by historical standards, dropped to 4.1% in June, according to the latest figures.[6] Core PCE inflation saw a slight increase, moving from 2.6% to 2.7%,[7] but remains within the Fed’s targeted range of 2%.

As illustrated in the graph, the last time inflation reached the current level, the Fed began cutting rates, which led to inflation creeping back up. With the additional factor of tariffs, it is understandable that the Fed would be cautious about triggering a similar rise in inflation.

Proponents of the view that inflation is poised to increase argue that the effects of tariffs have been delayed. This delay, for instance, could be attributed to businesses preemptively purchasing inventory (known as “front-loading”) to avoid higher costs or absorbing those costs temporarily to shield consumers. Some believe that the true impact of these measures will start to show up in the July data.[8]

The June CPI inflation figures, while showing a lower-than-expected increase for core CPI,[9] are still higher than in previous months, potentially lending weight to this view, although both sides maintain the data still supports their respective positions.

The Unfolding Drama

Trade negotiations have followed an erratic course, but a distinct pattern is emerging. Tariffs and deadlines seem to be provisional rather than permanent, setting the stage for more extensive trade talks.

On June 10th, discussions between the U.S. and China culminated in something of a truce, with a “framework” put in place to replace the initial punitive tariffs. With no other significant deals apart from the ones with the UK and Vietnam, the July 9th deadline has been pushed to August 1st, as negotiations with other countries continue.[10]

This new deadline, in Trump's words, is “Firm, but not 100% firm”. This phrase encapsulates his strategy of controlled chaos, designed to wear down the resolve of his global negotiating partners. Such a strategy, by its nature, has no defined end or outcome.

Conclusion

Domestically, Trump appears to be intensifying his verbal attacks on Powell, urging him to lower interest rates by at least 3% and/or resign immediately.[11] Trump officials have also been applying pressure on Powell through accusations of mismanagement and overspending.[12]

When asked to respond during the June press conference, Powell reaffirmed the Fed’s dual mandate, stating that the pursuit of this mandate is “all that matters” to him and the committee members.[13]

Regardless of opinions on Powell’s abilities, this attitude of remaining focused amid external pressures offers a valuable lesson for investors. The greatest threat to an investment strategy often lies not in the markets themselves but in the emotional responses they provoke. Maintaining composure is, therefore, a key part of successful investing.

[6] Bureau of Labor Statistics

Let’s build your bespoke solution

We can create tailor-fit portfolios that suit various investment strategies and risk profiles. Our private market specialists would be delighted to explore with you your investment needs.