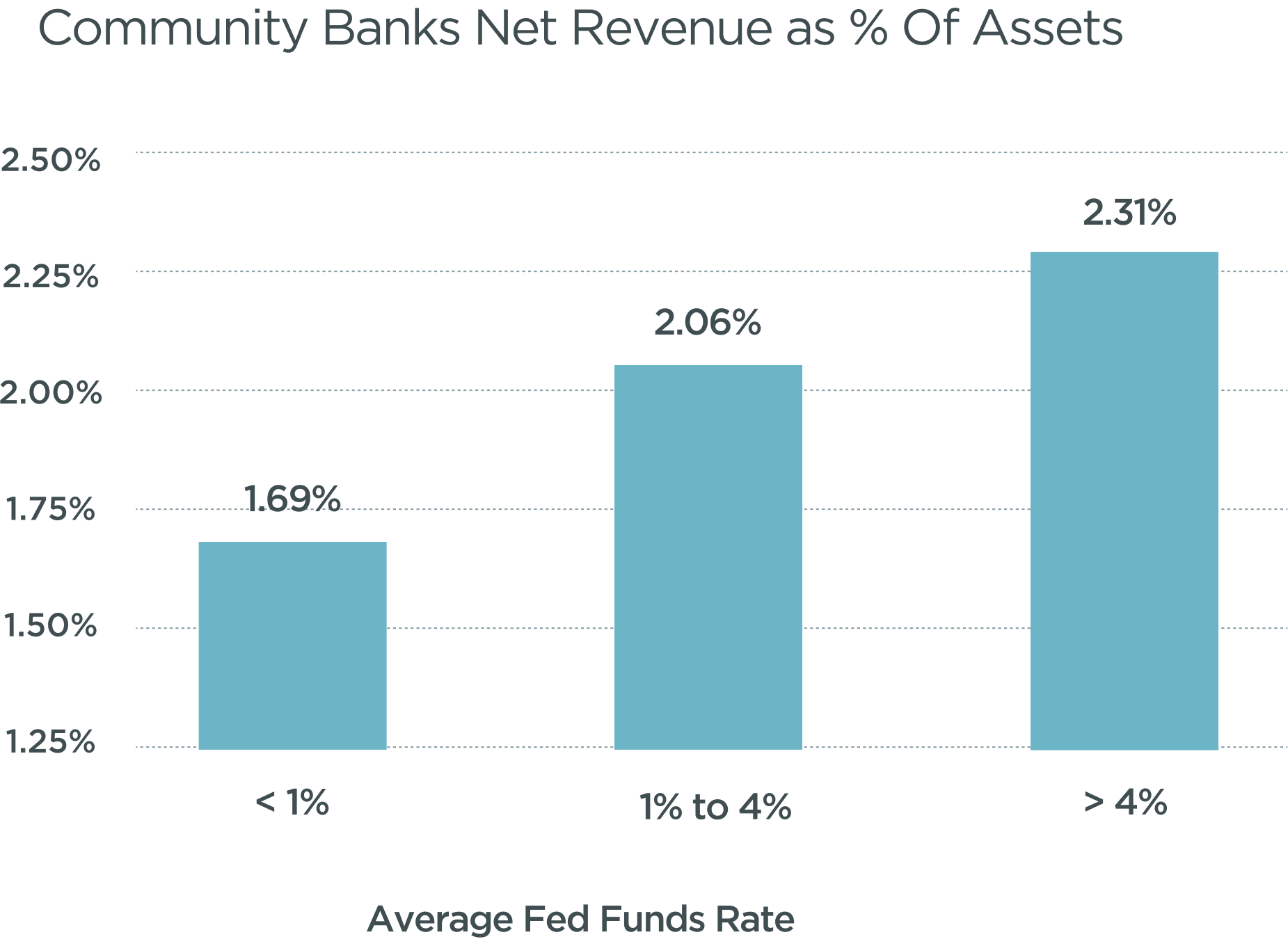

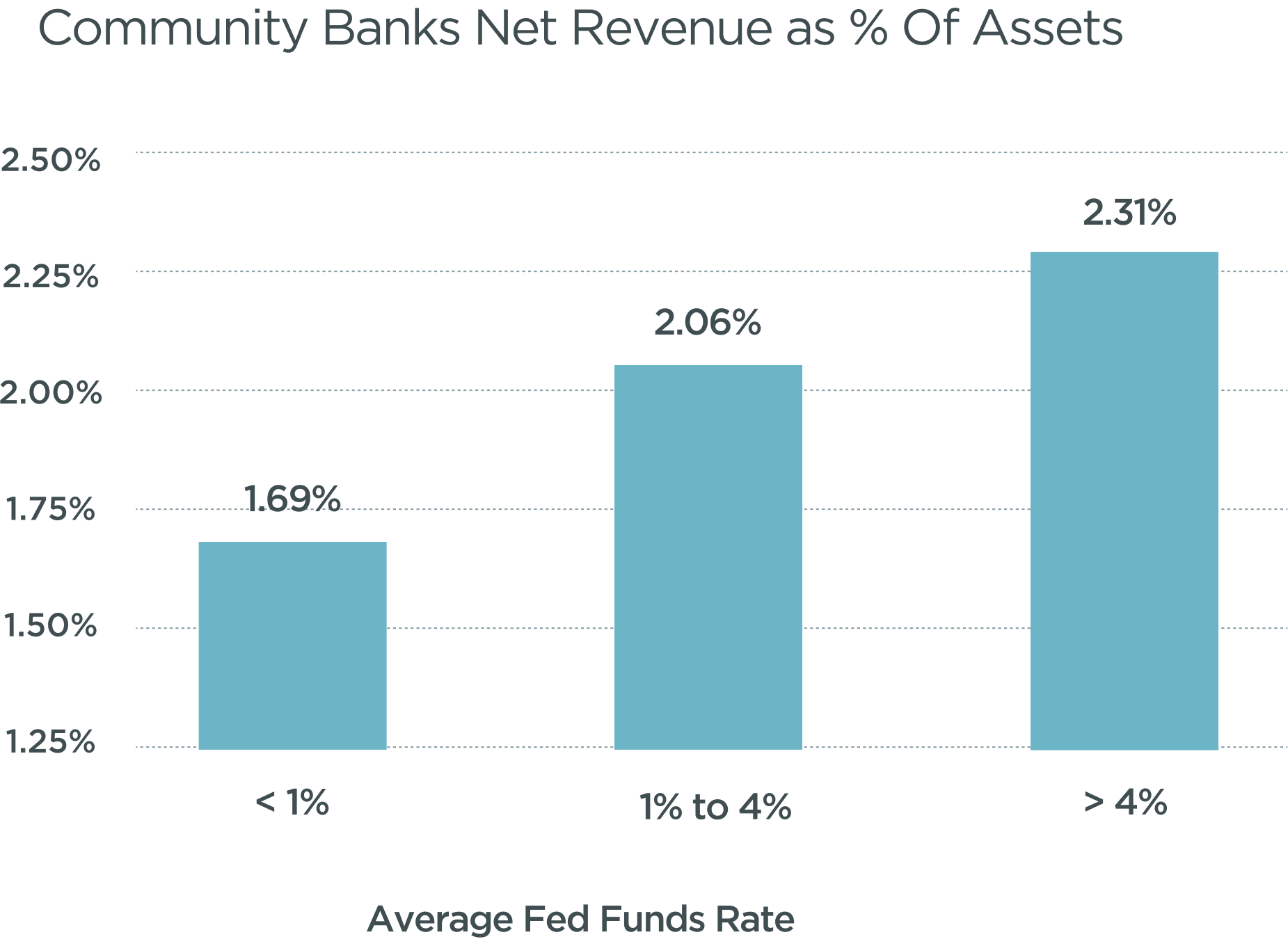

With rising interest rates, the profits of small-cap U.S. community banks are poised to soar by about one-third. In fact, they are the only sector in the economy which directly benefits from increasing rates. The higher rates go, the more money these banks make. This is because a significant portion of their funding comes from transaction accounts that pay little or no interest. As interest rates rise, the spread between their cost of funding and the interest they earn on loans will increase, driving up their margins and earnings. Going forward, community banks should be able to earn revenue as a percentage of their assets close to the 2.3% they earned when Fed Funds rates exceeded 4%. This is about 35% higher than the 1.7% revenue/assets they earned in the period after the Global Financial Crisis when interest rates were below 1%.

Community banks are very resilient

There are roughly 4,800 community banks in the U.S., each with assets of less than $10 billion. Of these, around 700 are listed or trade over the counter and present a very compelling investment opportunity.

Community banks are a unique and resilient force in the financial services industry. They are deeply embedded in their local communities and have a long history of serving their customers with whom they have built strong relationships. The deep understanding of their clients’ needs has nurtured a loyal customer base that is more likely to stick with the bank even in times of economic uncertainty.

The notion that community banks face significant risk of obsolescence from fintech challengers is also overblown. New entrants in the financial services industry face increasing regulatory scrutiny and have recently struggled with proper customer service and protection. This is a testament to the enduring value of traditional banking institutions, especially those deeply rooted in their local communities.

Investors are fearful to invest in banks in a slowing economy

The resilience of the community banks and the structural upside to profits in a higher rates regime is not at all reflected in their stock market valuations. They are shunned by institutional clients and trade at generationally low multiples on earnings of around 8 times currently compared to a historical average of 14-15 times in similar rate environments.

The trading illiquidity of small bank stocks can make it difficult to build or exit investment positions and has currently limited institutional involvement in the sector as investors are fearful of a recession and have shorter horizons.

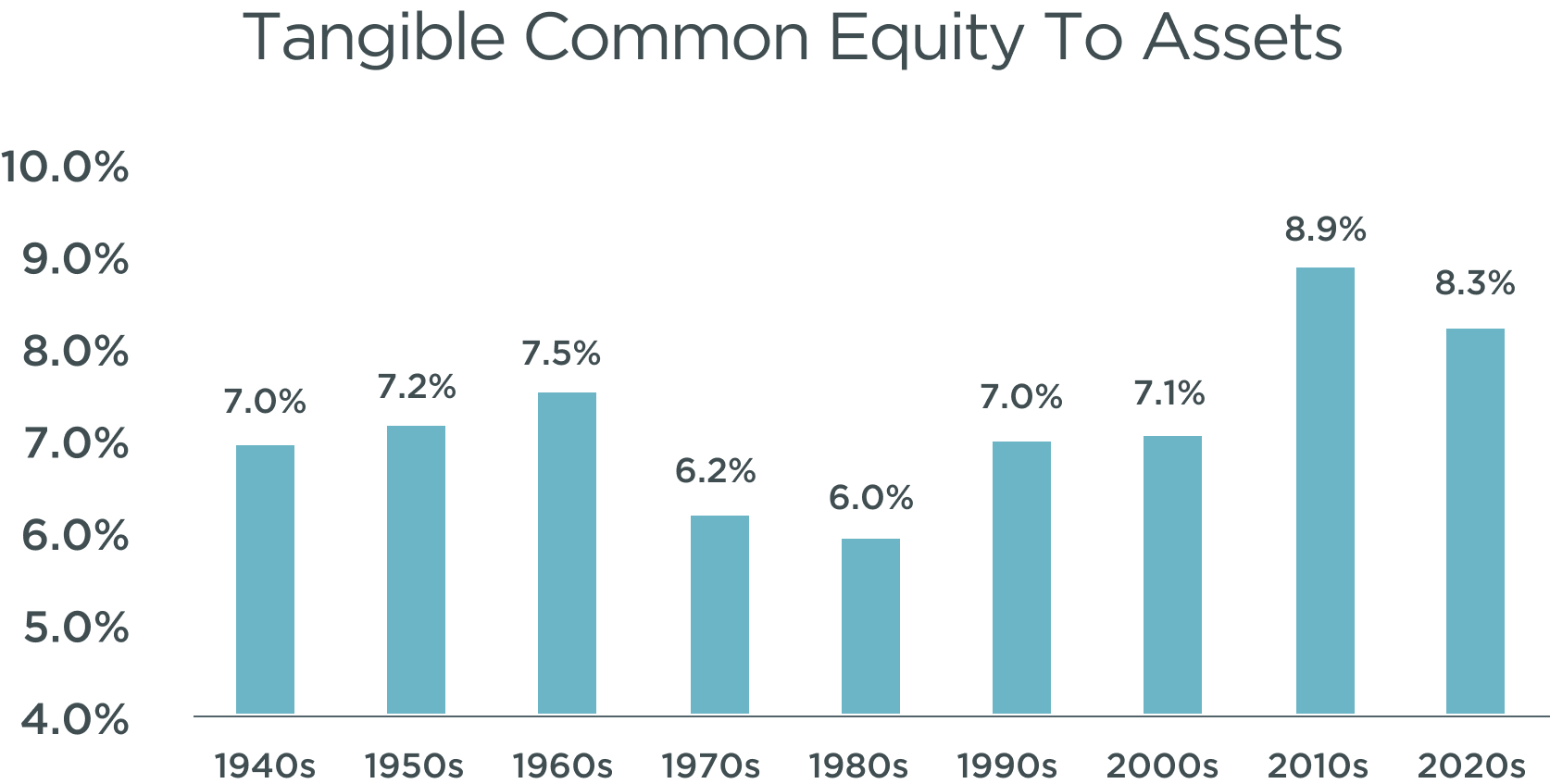

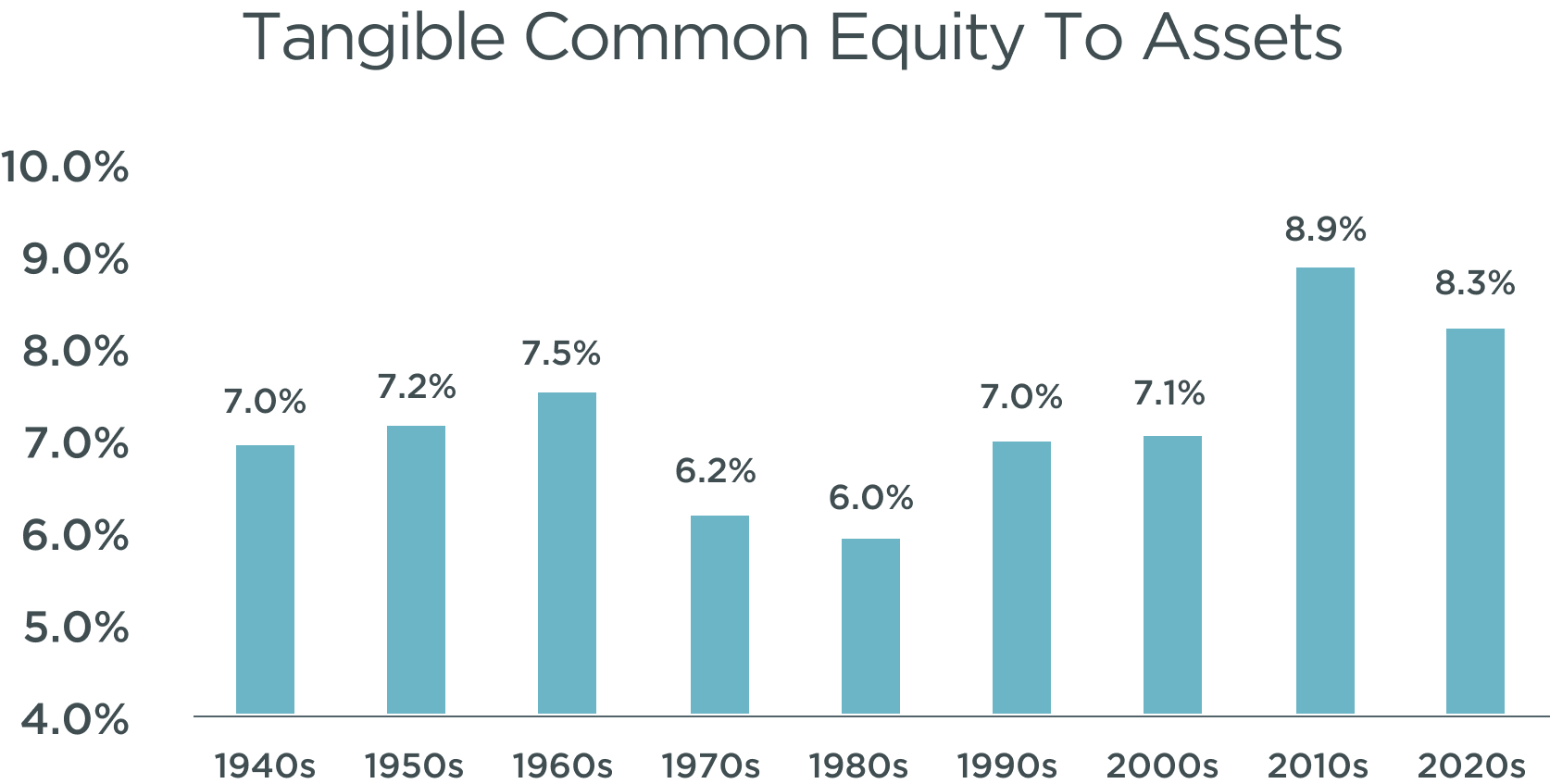

In addition, institutional clients are hesitant to invest in U.S. community banks due to memories of the Global Financial Crisis, the last major credit cycle. The fear of another recession has led many to avoid investing in the banking sector altogether. However, these fears are largely unwarranted. Banks have significantly tightened their underwriting standards, reducing the risk of substantial credit losses. Additionally, capital levels in U.S. banks have been built after the crisis to multi-decade highs and provide a strong buffer against future economic shocks.

Big gains from the small banks await the patient investors

U.S. community banks are a resilient sector of the economy, with a long history of strong customer relationships. The shift in the macro regime to higher interest rates is likely to drive outperformance for these small banks and their prices could double in the next 2-3 years as profits rise by a -third and valuation multiples re-rate 75-90% higher.

Community banks are currently undervalued by institutional buyers due to their illiquidity and concerns about an upcoming economic slowdown. However, the dislocation creates an opening for nimble, focused, and patient investors, such as our firm, to capitalize on the opportunity and generate above-market returns. Investors should focus on the long-term structural shift in rates that benefits banks tremendously and use any near-term noise and market price correction during a recession to accumulate positions at extremely attractive prices.

Disclaimer

The statements and data in this publication have been compiled by Petiole Asset Management AG to the best of its knowledge for informational and marketing purposes only. This publication constitutes neither a solicitation nor an offer or recommendation to buy or sell any investment instruments or to engage in any other transactions. It also does not constitute advice on legal, tax, or other matters. The information contained in this publication should not be considered as a personal recommendation and does not consider the investment objectives or strategies or the financial situation or needs of any particular person. It is based on numerous assumptions. Different assumptions may lead to materially different results. All information and opinions contained in this publication have been obtained from sources believed to be reliable and credible. Petiole Asset Management AG and its employees disclaim any liability for incorrect or incomplete information as well as losses or lost profits that may arise from the use of information and the consideration of opinions.

A performance or positive return on an investment is no guarantee for performances and a positive return in the future. Likewise, exchange rate fluctuations may have a negative impact on the performance, value, or return of financial instruments. All information and opinions as well as stated forecasts, assessments, and market prices are current only at the time of preparation of this publication and may change at any time without notice.

Duplication or reproduction of this publication, in whole or in part, is not permitted without the prior written consent of Petiole Asset Management AG is not permitted. Unless otherwise agreed in writing, any distribution and transmission of this publication material to third parties are prohibited. Petiole Asset Management AG accepts no liability for claims or actions by third parties arising from the use or distribution of this publication. The distribution of this publication may only take place within the framework of the legislation applicable to it. It is not intended for individuals abroad who are not permitted access to such publications due to the legal system of their country of domicile.