The significance of asset allocation cannot be overstated. The renowned Brinson, Hood, and Beebower study demonstrated that this policy accounts for over 90% of the variability in a portfolio's return.[1] Essentially, it serves as the architectural blueprint for wealth growth and preservation.

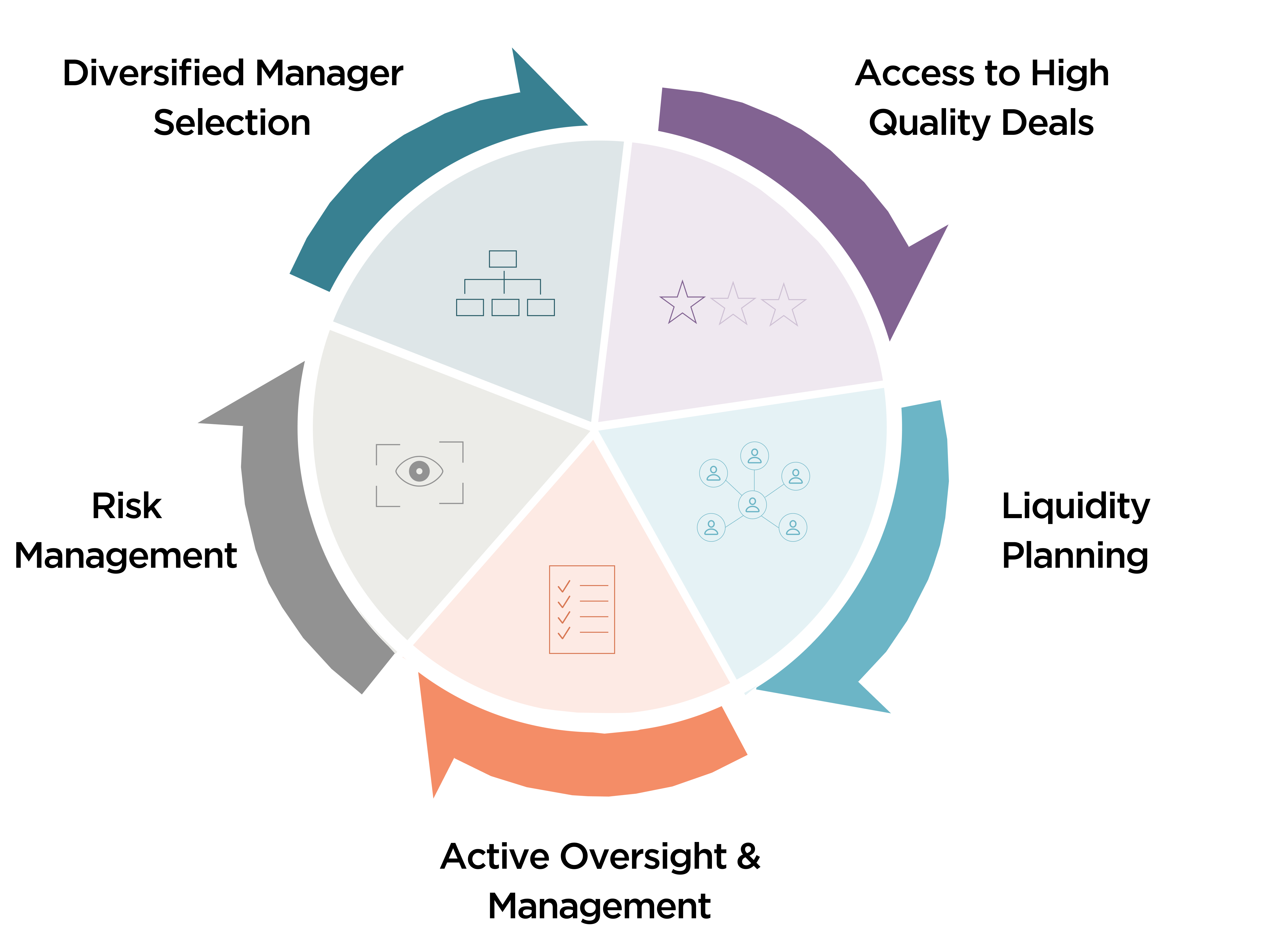

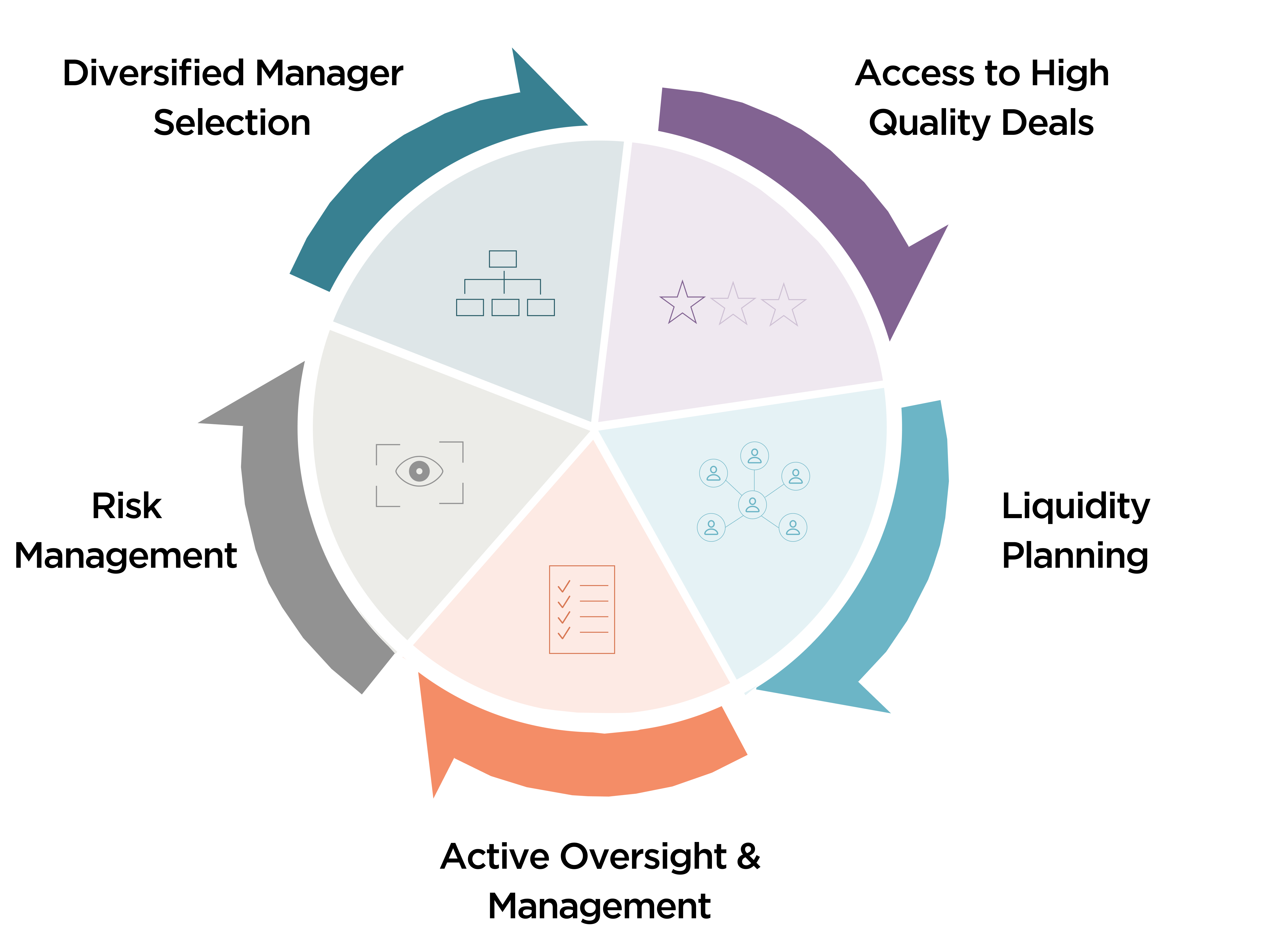

Yet, a blueprint alone is insufficient to construct a lasting structure. Its true potential is realized only through effective execution. For many investors, the impact of asset allocation remains an abstract concept, as they lack the essential components to bring it into reality. The difference between a theoretical plan and a resilient, performing portfolio lies in the discipline and capability of its execution. To harness the full potential of asset allocation, investors must master five critical execution factors.

1. Selection of Diversified, Top-Quartile Managers

1. Selection of Diversified, Top-Quartile Managers

Identifying investment managers who consistently outperform is a rigorous, full-time task. This process demands thorough due diligence that assesses not only historical returns but also investment processes, operational integrity, and team dynamics. An institutional approach minimizes the risk of relying on a single manager in any given area. Instead, it builds a diversified group of specialists, each enhancing the portfolio's strength.

2. Access to Premium, Differentiated Opportunities

An institutional approach to asset allocation goes beyond a simple combination of public equities and bonds. True diversification and the potential for enhanced returns often reside in private markets: private equity, venture capital, real estate, and private credit. The best investment opportunities in these areas are rarely made public and are sourced through established networks, trusted relationships, and a reputation as a value-added partner. Access to these opportunities often represents the first and most significant barrier to entry.

3. Proactive Liquidity Planning

Investing in illiquid private markets offers the potential for superior returns but requires a long-term commitment of capital. Without detailed liquidity planning, this can become a significant risk. An execution-focused strategy involves forecasting both short-term and long-term liquidity needs, whether for lifestyle, taxes, philanthropy, or new ventures. This forecast is then aligned with the investment portfolio’s capital call schedules and distribution timelines, ensuring cash is available when necessary.

4. Active Oversight and Dynamic Management

An asset allocation policy is not a static document. It demands ongoing oversight. This includes the discipline to rebalance the portfolio by trimming overperforming assets and reallocating to underperforming ones to stay aligned with long-term targets. Active management also involves monitoring of managers and adjusting strategies to capitalize on market dislocations or mitigate emerging risks. This approach ensures that the portfolio remains aligned with the investor’s strategic objectives, while adapting to the changing economic environment.

5. Comprehensive Risk Management Framework

Risk management within an institutional setting extends beyond simple diversification. It requires a comprehensive, 360-degree approach to potential threats. This means stress-testing the portfolio against a variety of macroeconomic scenarios, identifying hidden correlations between assets that may arise during crises, and managing non-financial risks such as counterparty and operational vulnerabilities. It is a proactive approach aimed at identifying potential pitfalls and implementing safeguards to protect capital before they occur.

In conclusion, while a clearly defined asset allocation plan is a critical starting point, it is the meticulous execution of these five components that unlocks its true value. This continuous cycle of access, selection, planning, risk management, and oversight demands scale, deep expertise, and unwavering commitment. For investors who seek to ensure their wealth-building blueprint endures over time, the essential question is not simply "What is our asset allocation?" but "Do we possess the institutional capability to execute it effectively?".

[1] Brinson Et Al. (1986) - Determinants of Portfolio Performance

1. Selection of Diversified, Top-Quartile Managers

1. Selection of Diversified, Top-Quartile Managers