Private Debt in Portfolios institutioneller Anleger

Beständigere Erträge, attraktive risikobereinigte Renditen und Diversifizierung – dies sind nur einige der Vorteile, die institutionelle Anleger dazu veranlassen, Private Debt in ihre Portfoliostrategien aufzunehmen.

Private Debt in Portfolios institutioneller Anleger

Seit der globalen Finanzkrise im Jahr 2008 wurde die Kreditvergabe der Banken durch neue Vorschriften wie Basel III eingeschränkt. Private Debt hat diese Finanzierungslücke geschlossen. Infolgedessen ist die Anlageklasse nach Schätzungen von S&P Global in den letzten zehn Jahren um das Zehnfache auf USD 412 Mrd. gewachsen.

Aktuell befinden wir uns ausserdem in einem Umfeld steigender Zinsen. Das heisst, traditionelle festverzinsliche Anlagen können nicht mehr als Ballast für Aktien in einem Portfolio dienen. Da Private Debt nicht zu Marktpreisen bewertet wird und mit flexiblen Zinsen zinssicher ist, spielt die Anlageklasse inzwischen eine strategisch wichtige Rolle in den Portfolios institutioneller Anleger.

Doch wie sollten Institutionen bei der Allokation in diese Anlageklasse vorgehen?

Private Debt: Der Allokationsprozess

I. Strategie

Als erstes muss die Höhe der Allokation in Private Debt strategisch festgelegt werden. Dabei sind drei Aspekte zu berücksichtigen:

Angesichts der unterschiedlichen Strategien und des illiquiden Charakters der Transaktionen liegen für Private Debt keine zuverlässigen und beobachtbaren monatlichen Daten zur Rendite vor, aus denen sich Muster ableiten liessen.

Aufgrund der geringen Volatilität von Private Debt müssen Anlegerinnen und Anleger entscheiden, ob sie Risiken als fundamentale Risiken oder als Mark-to-Market-Volatilität bewerten.

Bis ein solider Bestand an Privatkrediten aufgebaut ist, dauert es ungefähr zwei bis vier Jahre.

II. Diversifizierung

Als nächstes müssen die idealen Diversifizierungsparameter festgelegt werden. Eine Diversifizierung kann über die folgenden Faktoren erreicht werden:

Art des Kreditnehmers: Unternehmen oder Sachwerte

Strategie: Senior Secured Loans, Mezzanine-Kredite, notleidende Kredite, besondere Situationen

Region: weltweit, Nordamerika, Europa, Asien

Manager: Optimale Anzahl von Managern und unterschiedliche Zeitpläne für die Mittelbeschaffung

Zeit: unterschiedliche Jahrgänge

III. Cashflow-Planung

Verschiedene Manager haben unterschiedliche Zeitpläne für die Mittelbeschaffung und das Investitionstempo. Daher müssen Anlegerinnen und Anleger überlegen, wie sie künftige Cashflows planen oder zeitlich festlegen, um die angestrebte Allokation in Private Debt beizubehalten. Eine wirksame Cashflow-Planung ermöglicht zudem eine Diversifizierung über die verschiedenen Jahrgänge hinweg und eine Ausrichtung auf Märkte, die zu einem bestimmten Zeitpunkt möglicherweise attraktiver sind.

IV. Due Diligence

Anlegerinnen und Anleger müssen sorgfältig analysieren, ob die Ergebnisse eines Managers mit dem Risikoprofil der gewählten Strategie übereinstimmen. Zu den entscheidenden Faktoren, die es zu berücksichtigen gilt, zählen die Erfahrung des Teams, der Wettbewerbsvorteil, die Beschaffungskapazitäten, die Fähigkeiten zur Kreditgewährung, der Ausfallschutz und die Restrukturierungserfahrung sowie die Verlust- und die Rückgewinnungsraten.

Auswahl von Private-Debt-Strategien

Im Bereich Private Debt gibt es die folgenden Strategien:

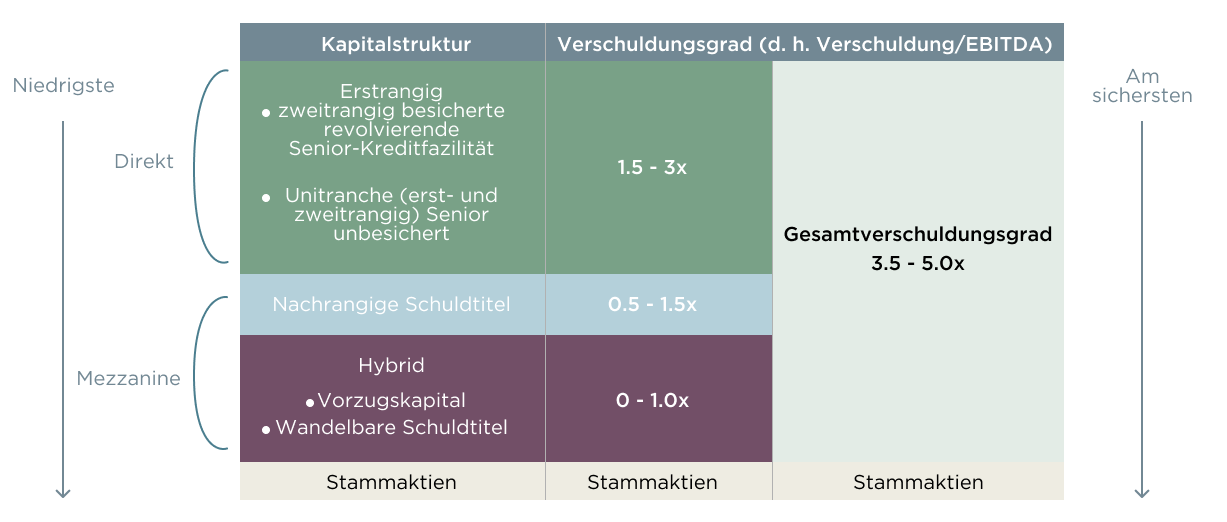

Direkte Kreditvergabe: Hierbei handelt es sich um Kredite, die ausserhalb des Bankensektors an Unternehmen vergeben werden. Kredite können als erst- und zweitrangige Darlehen, Stretched Senior oder Unitranche (sowohl erst- als auch zweitrangig) vergeben werden. Erstrangige Darlehen stehen in der Kapitalstruktur ganz oben und werden als erstes zurückgezahlt, wie in der folgenden Grafik dargestellt. Direkt vergebene Kredite sind in der Regel besichert und an Bedingungen (Covenants) gebunden.

Mezzanine-Kredite: Hierbei handelt es sich um Kredite, die gegenüber erst- und zweitrangigen Krediten nachrangig sind. Diese Kredite sind in der Regel unbesichert, bieten aber die Möglichkeit, am potenziellen Wertzuwachs des Kreditnehmers zu partizipieren (z. B. durch Optionsscheine).

Notleidende Kredite: Hierbei handelt es sich um Kredite, die an Unternehmen in Stresssituationen (z. B. Spread 600–800 Basispunkte über dem risikofreien Zinssatz) oder in einer Notlage (z. B. Spread >1’000 Basispunkte) vergeben werden. Zu den Strategien gehören der Handel (d. h. Quick Flips), keine Unternehmenskontrolle (Beeinflussung von Restrukturierungsverhandlungen) und die Kontrolle (Umwandlung von Schuldtiteln zur Kontrolle des Eigenkapitals).

Besondere Situationen: Hierbei handelt es sich um flexible Kapitallösungen, die nicht in eine der oben genannten Kategorien fallen. In der Regel handelt es sich bei der Kreditvergabe in besonderen Situationen um opportunistische Kredite mit eigenkapitalgebundenem Wertzuwachs, wenn die Liquidität des Marktes gering und der Wert hoch ist, oder in Situationen, die eine hochspezialisierte Kreditvergabe erfordern.

Nischenstrategien: Beispiele hierfür sind Handelsfinanzierung, Lizenzgebühren, Flugzeugleasing usw.

Allokation in Private-Debt-Manager

Nach Angaben von Preqin gibt es derzeit über 2’000 Manager, die eine Private-Debt-Strategie verfolgen. Wie sollten Anlegerinnen und Anleger also bei der Auswahl eines Managers vorgehen?

Das Private-Debt-Geschäft ist stark beziehungsorientiert. Bei Managern, die Deals sponsern (d. h. Finanzierung von Private-Equity-Deals), sind die Zahl der Partnerbeziehungen und die Zahl der wiederholten Partnerbeziehungen hilfreiche Indikatoren. Einige Manager haben eine hohe Anzahl von wiederholten Deals. Darin spiegelt sich häufig ihre Fähigkeit wider, einen Deal schnell, zuverlässig und flexibel auszuführen. Manager, die nicht gesponserte Deals abschliessen, verfügen in der Regel über spezifische Branchenkenntnisse, die ihnen einen Vorsprung verschaffen, zum Beispiel in spezialisierten Sektoren wie dem Gesundheitswesen.

Anlegerinnen und Anleger sollten sich für Manager entscheiden, die einen differenzierten Mehrwert schaffen können. So können Manager, die als federführende Kreditgeber fungieren, auf verschiedene Weise Mehrwert schaffen, denn sie sind beispielsweise in der Lage, die Preisgestaltung, die Struktur des Deals und die Konditionen zu kontrollieren. Solche Manager erhalten in der Regel höhere Deal-Gebühren und können die operativen und finanziellen Kennzahlen eines Kreditnehmers besser verfolgen. Die federführenden Kreditgeber können zudem das Verfahren besser kontrollieren, wenn sich ein Kredit schlecht entwickelt. Andere Möglichkeiten der Wertschöpfung sind die Spezialisierung auf Sektoren, Regionen oder Nischen (z. B. KMU im unteren Mittelstand), die weniger effizient sind, oder das Know-how darüber, wie ein Turnaround vollzogen werden kann, wenn ein Kredit auszufallen beginnt. Einige Manager verwalten auch stark diversifizierte Portfolios von mehreren hundert Krediten.

Wie hoch sind die Ausfall-, Verlust- und Rückgewinnungsraten eines Managers? Zahlen sind wichtig. Sie sind wichtige Anhaltspunkte dafür, ob die Massnahmen eines Managers zur Verlustabsicherung ausreichend sind. Auf dem Papier mag es sich perfekt anhören, wenn ein Manager noch nie einen Zahlungsausfall verzeichnet hat. Allerdings kann dies ein potenzieller Schwachpunkt sein, da der Manager möglicherweise nicht über die Erfahrung verfügt, mit problematischen Krediten umzugehen. Ideal ist ein Manager, der bereits mehrere Zyklen durchlaufen hat.

Ausserdem sind folgende Fragen zu berücksichtigen: Wie schnell wird das Portfolio auf- und abgebaut, und welche Gebühren werden erhoben? Werden die Gebühren auf das gebundene oder das investierte Kapital erhoben? Ist ein gehebelter Portfolioanteil vorgesehen? Wie sichert der Manager in der Regel das Abwärtsrisiko ab und wie hoch ist der Beleihungswert (Loan-to-Value, LTV) des durchschnittlichen Deals?

Fazit

Eine Allokation in Private Debt in einem institutionellen Portfolio ist zwar kein komplizierter Prozess, diesen gut auszuführen bleibt aber dennoch eine Herausforderung. Die Branche entwickelt sich so dynamisch, dass es für alle, die nicht in ihr tätig sind, schwierig ist, Schritt zu halten.

Im Rahmen der diversifizierten Anlageprogramme für den Privatmarkt von Petiole nutzen wir seit mehreren Jahren das Potenzial von Private Debt. Setzen Sie sich noch heute mit uns in Verbindung, um herauszufinden, wie Sie Private Debt in Ihre Anlagestrategie integrieren können.

Sie möchten mehr erfahren?