Private Equity Attracts More Pension Funds

Many institutional investors are moving away from their traditional reliance on public markets, particularly fixed income, in pursuit of higher-yielding and more stable assets such as private equity.

Government retirement funds in the US are pumping record sums into private equity. US pension funds’ private-equity investments grew to an average 8.9% of holdings in 2021, after three consecutive years of growth, reports the analytics company Preqin. (1)

The same trend can be seen around the globe. A recent report by the investment consulting firm bfinance, for example, found that nearly two-thirds of insurers—many of which manage retail pension-fund savings—plan to reduce their exposure to fixed income over the next 18 months or so, and switch into private equity and other asset classes. (2)

Inflation’s Upward Pressure on Yields

Traditionally, pension funds and other institutional investors have relied on fixed-income assets to generate the regular cash flows they need to fund their liabilities.

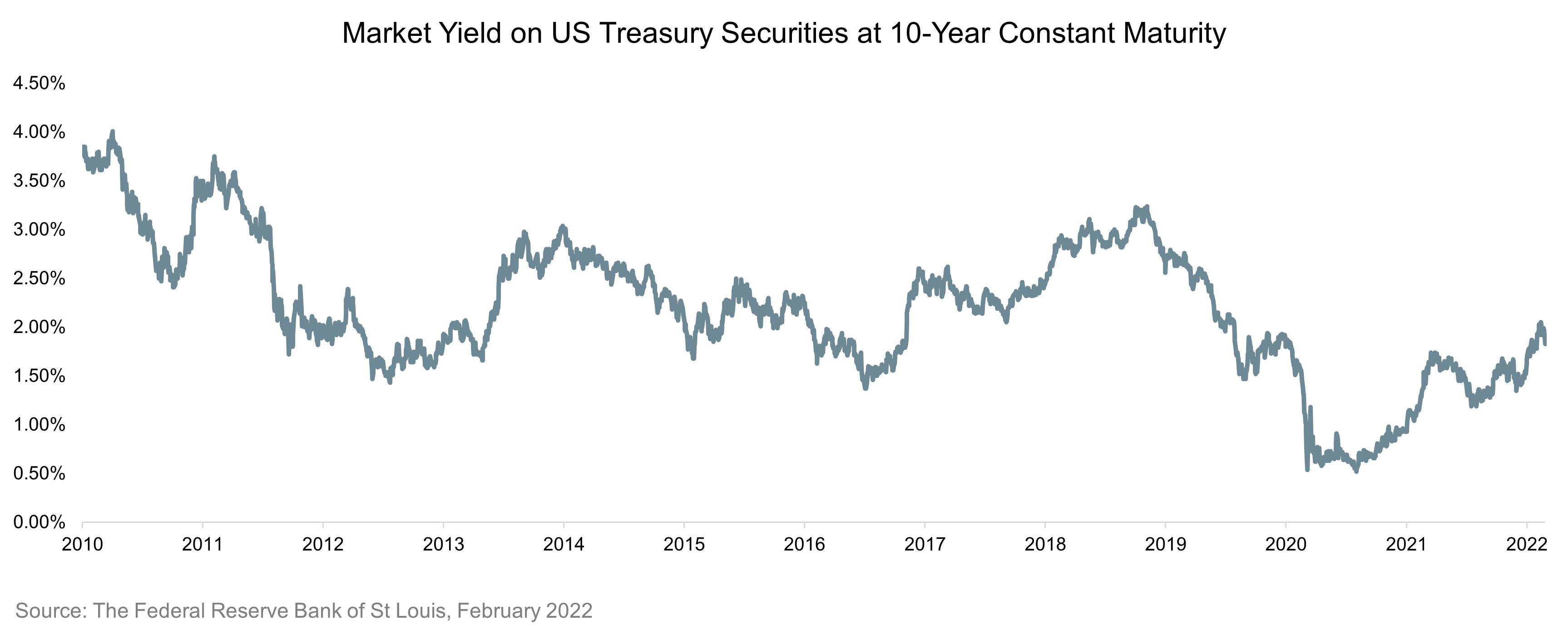

Various factors are driving the switch away from bonds and into private equity and elsewhere. They include the recent resurgence of inflation. Fixed-income yields, having fallen to record lows in recent years, are now facing upward pressure on inflationary concerns and the prospect of tightening monetary conditions. Yields have been on an upward trend since mid-2020 and are almost certain to go higher this year. Inflation in the US rose to an annual pace of 7.5% in January, the highest level seen in 40 years. (3)

In February, interest-rate futures were pricing in 164 basis points of policy tightening in 2022 alone, with further hikes expected in 2023. (4) That suggests the upward trend in yields could continue for some time, inflicting losses on bond investors as prices move down. Pricing Power is the Key

Pricing Power is the Key

Inflation can also pose a risk to private equity. Highly leveraged companies will clearly face challenges if borrowing costs rise sharply. Higher input costs for labor and raw materials can also hit profits. However, the outlook for private equity is far more positive than for fixed income, particularly if a portfolio is focused on companies with strong pricing power: the ability to increase prices without losing sales or market share.

Warren Buffett once described pricing power as the most important factor in evaluating a business. Strong brands, a dominant market position, or a technological edge can generate this pricing power and allow a company to pass higher costs on to consumers. It is likely to become a key competitive advantage in the next year or two.

Labor costs are also likely to rise as workers press for wage increases to counter the impact of inflation. Companies with a record of harmonious labor relations will clearly fare best in this environment. In addition, companies with the ability to automate will have an advantage over those that are dependent on growing their workforce in line with revenue.

Private Equity’s Advantages Over Public Markets

I. Stability

Back in 2013, the Federal Reserve chairman Ben Bernanke surprised the market by indicating “the Fed” would start reducing, or tapering, its bond-buying program. That caused bond yields to spike and the stock market to nosedive. The “taper tantrum,” as it became known, highlighted the vulnerability of equities, as well as fixed income, to tighter monetary policy.

The volatility of equities has undermined their appeal to institutional investors seeking regular, long-term income streams. By contrast, private equity, due to its long investment horizon, is far less vulnerable to market corrections. Certainly, pension schemes in the UK and elsewhere have been reducing their exposure to equities, partly to de-risk their portfolios but also to gain exposure to higher-yielding assets, such as private equity. II. Superior Returns

II. Superior Returns

The most persuasive argument for pension funds to invest in private equity is the latter’s ability to provide good returns on an absolute and relative basis. US public pension funds, for example, generated more than 12% annualized return from their private-equity investments, net of fees, between 2010 and 2020, according to the American Investment Council. That made private equity the best-returning asset class for public pension portfolios over the period.

The study analyzed 178 US public pension funds, representing nearly 34 million public-sector workers and retirees. Around 85% of public pensions in the sample had some exposure to private equity. The long-term nature of private equity investing, as well as the illiquidity premium, explains these superior returns. Investments in public markets are often focused on the very short term, driven by factors such as quarterly earnings expectations. By contrast, private-equity managers can look much farther into the future and encourage the management of the firms in which they invest to do the same. That creates a much better environment in which to build a company that can deliver superior long-term returns.

The long-term nature of private equity investing, as well as the illiquidity premium, explains these superior returns. Investments in public markets are often focused on the very short term, driven by factors such as quarterly earnings expectations. By contrast, private-equity managers can look much farther into the future and encourage the management of the firms in which they invest to do the same. That creates a much better environment in which to build a company that can deliver superior long-term returns.

Fund managers’ experience of investing in similar companies and/or businesses in similar industries means they can help management in its decision-making and exercise a degree of control or influence over the future direction, performance and growth path of the company.

Matching Liabilities

The long-term nature of private equity provides a good match for the long-term liability profile of pension funds. Private returns generated over a ten-year period or longer can help pension funds with liability matching alongside more liquid investments, while also providing a premium for illiquidity.

Diversification Benefits

Private equity provides diversification benefits to pension funds. It offers investors access to private companies that are hard to gain exposure to via other asset classes. These companies are often small, fast-growing businesses that are under the radar of other types of fund manager. The American Investment Council found that 80% of private-equity investment supported small businesses in 2021.(5)

Addressing Investor Concerns on the Environment and other Matters

Environmental, social, and governance (ESG) considerations have become an increasingly important part of investment and portfolio management decisions in private equity over the past few years. Indeed, private-equity managers are well placed to engage with the leaders of the businesses they invest in, and encourage them to address these issues, given the long-term relationships that develop.

Finding a Home for Surplus Cash

Thanks to booming stock markets, pension funds in the US and elsewhere need to find a home for their newfound cash piles. For the reasons outlined above, that cash is shifting away from bonds and stocks, and into private equity. Some funds have also started reinvesting gains from existing private-equity investments as a means of deploying the capital into the asset class more quickly.

Challenges

The private-equity market is increasingly competitive as more cash flows into the sector in pursuit of superior returns. Consequently, good investments are becoming harder to find and access, highlighting the need to choose a partner with a long track record and established relations in the industry.

Key takeaways

Inflationary pressures are accelerating the long-term migration of institutional assets away from public markets.

Private equity is well placed to offer protection against inflation and deliver superior and stable long-term returns.

The increasingly competitive nature of private equity and the threat inflation poses to particular companies underlines the necessity of choosing a skilled and experienced partner.

Petiole Asset Management grew its expertise in private equity through many cycles of investing in this asset class. We maintain a disciplined approach in deal selection, risk management and portfolio construction. Contact our team to know our private equity investment solutions.

References

Retirement Funds Bet Bigger on Private Equity, Wall Street Journal, 01/10/22

Bye-bye bonds: Pension funds signal exit from traditional fixed income to private equity and real estate, i newspaper, 01/18/22

US inflation surges to 7.5% in fastest annual rise for 40 years, Financial Times, 02/10/22

Fed’s loudest hawk ramps up odds for monster rate hike after hot inflation data, Reuters, 02/10/22

Private Equity on Pace to Invest Over $1 Trillion in US Economy in 2021, American Investment Council, 11/22/21

Interested in learning more?